Prediction Markets: From Belief to Price Signals

Most people share opinions about the future all the time. Prices will go up. A product will fail. A technology will win. An election will swing. These opinions show up in conversations, social media threads, and headlines. They are loud but cheap. Being wrong rarely costs anything. Yet real decisions like investments, policies, and product bets are often made in the noise they create.

Prediction markets start from a different premise: what if expressing a belief required commitment?

A prediction market is a system where people express what they believe about the future by putting real value behind it. Instead of voting, arguing, or posting takes, participants trade on possible outcomes. Belief becomes measurable not because someone claims confidence, but because they are willing to risk capital.

The question shifts quietly but decisively:

Not “What do you think will happen?”

But “What are you willing to back with money?”

Belief With Skin in the Game

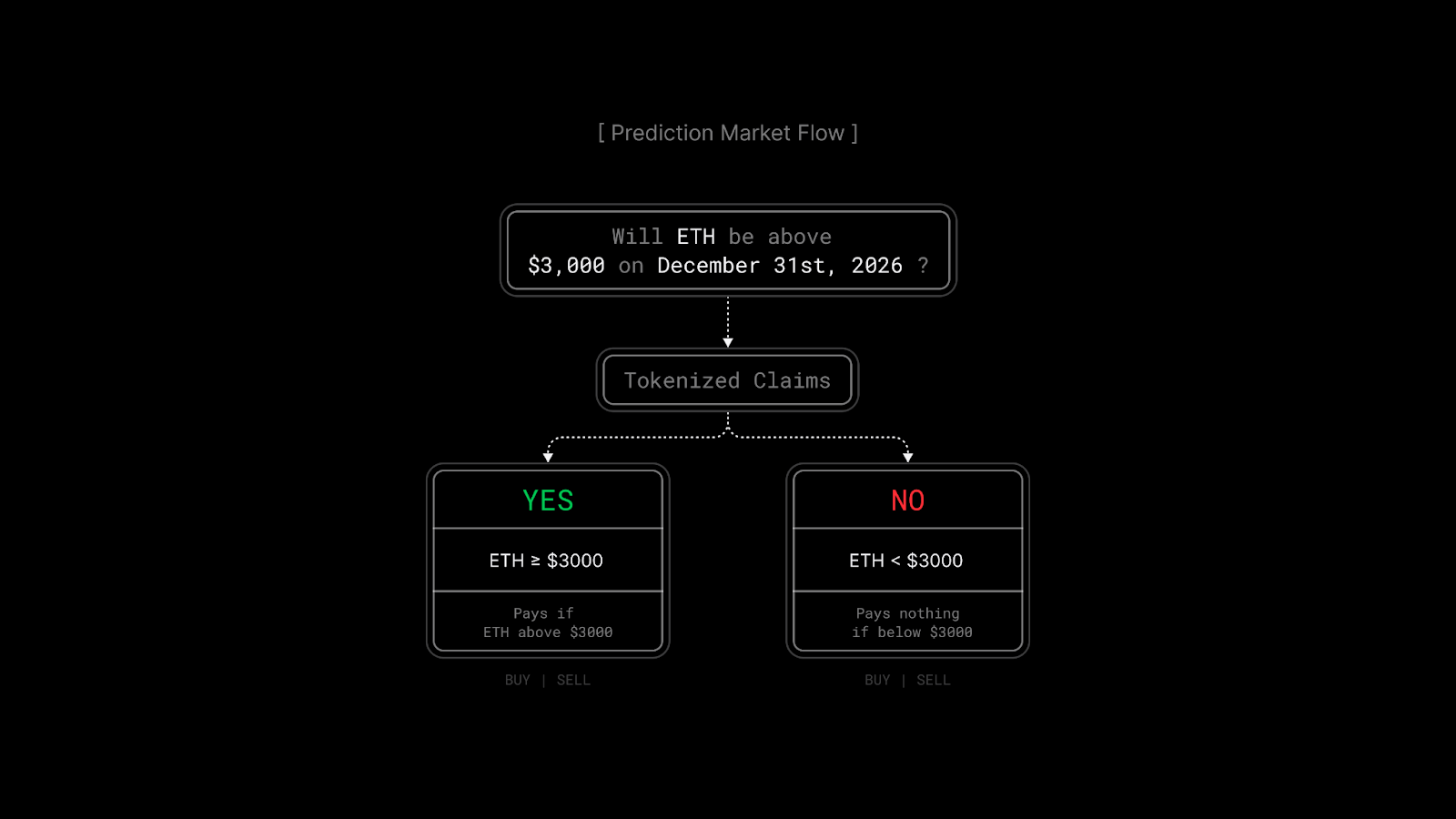

In a prediction market, each possible outcome of an event is represented by a tokenized claim. If the outcome happens, the token pays out. If it doesn’t, the token expires worthless.

Each can be bought or sold before the event resolves. These tokens are not predictions in isolation. They are positions. Owning one means you have something to gain if you are right, and something to lose if you are wrong.

The cost is simple and unavoidable: capital moves from those who were wrong to those who were right.

That difference matters. It filters out casual opinions and amplifies informed ones. People with better information, stronger conviction, or higher confidence tend to put more capital behind their beliefs. Over time, those incentives shape the market.

Prices Become Probabilities

As trading activity builds up, something interesting happens. The price of each outcome token begins to resemble a probability.

If the YES token trades at $0.62, the market is effectively saying: there is about a 62% chance this outcome will occur. If the NO token trades at $0.38, it reflects the opposite view.

No surveys. No debates. No appeals to authority. Just incentives interacting in public.

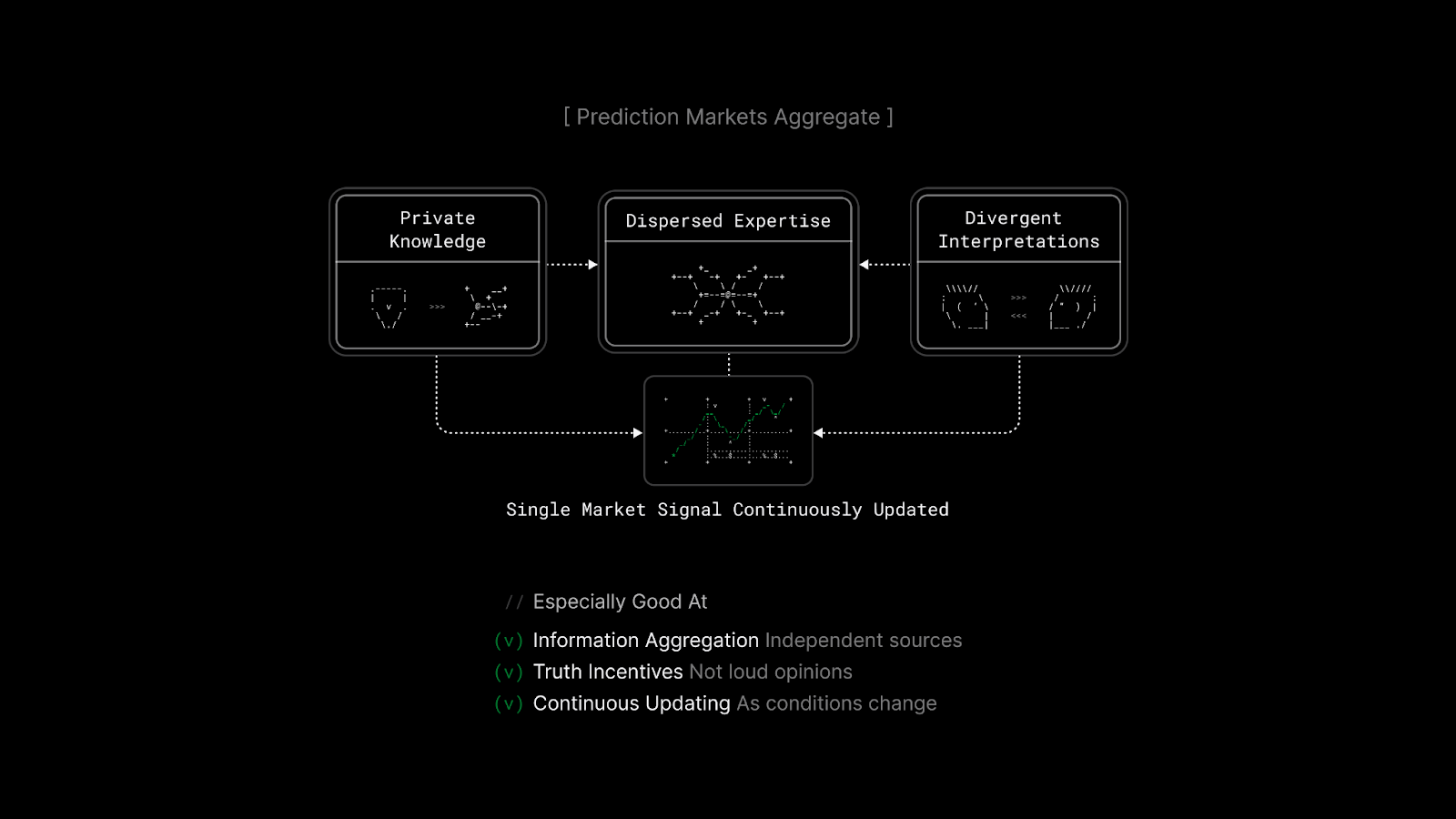

This doesn’t mean the market is “correct” in an absolute sense. The price merely reflects the current collective belief of everyone participating, weighted by how much they are willing to risk. That belief updates continuously. New information, rumors, data releases, or changing expectations all show up as price movements. Prediction markets don’t freeze belief at a single moment. They keep asking the same question, over and over again, in real time.

AMMs and Continuous Belief

Modern prediction markets usually rely on Automated Market Makers (AMMs) rather than traditional order books. The effect is subtle but important. AMMs:

- Always quote a price

- Adjust automatically as trades occur

- Allow entry and exit at any time

Every trade nudges the price slightly. Buying YES pushes its price up. Selling YES or buying NO pushes it down. The AMM translates disagreement into movement rather than drag.

Liquidity pools absorb uncertainty. When participants hold different views, those differences don’t stall the market. They smooth into gradual shifts. That is why prediction markets feel alive. Not only do prices respond to major news, but also to small changes in confidence.

The result is intuitive: the token price behaves like a probability, even though it is produced entirely by trading behaviour.

Markets as Information Machines

At first glance, prediction markets are often mistaken for betting systems. The mechanics look familiar, and outcomes feel binary. But that framing misses what these systems are really designed to do.

Prediction markets optimize for information. Participants are rewarded for being right and penalized for being wrong. Over time, that incentive structure encourages honesty, precision, and early insight.

The question prediction markets answer is direct: what does the market collectively believe right now? Not what it believed yesterday. Not what it will conclude at resolution. What it believes in this moment, given everything it knows so far.

Signals Over Settlements

Seen this way, prediction markets are best understood not as places to gamble, but as signal generators. They turn belief into a price. They translate uncertainty into probabilities. They make expectations visible, measurable, and tradeable.

What they don’t do, at least on their own, is act. They observe belief, record it, and refine it. But they stop there. And that limitation only becomes clear once we understand how informative, and perhaps even actionable, the signal itself really is.

About Reactive Network

Reactive is an EVM-compatible execution layer for dApps built with Reactive contracts. These contracts differ from traditional smart contracts by using inversion-of-control for the transaction lifecycle, triggered by data flows across blockchains rather than by direct user input.

Reactive contracts listen for event logs from multiple chains and execute Solidity logic in response. They can determine autonomously when to transmit data to destination chains, enabling conditional cross-chain state changes. The network delivers fast and cost-effective computation via a proprietary parallelized EVM implementation.

Website | Blog | Twitter | Telegram | Discord | Reactive Docs

Build once — react everywhere!