Prediction Markets: From Signal to Action

By the time prediction markets moved on-chain, belief had become legible. Trust was minimized. Participation was permissionless. Prices updated continuously. Signals could be read by anyone, at any moment.

But legibility is not agency. Markets could tell us what people believed while it still mattered, yet nothing on-chain responded to that belief. Measurement improved. Action did not.

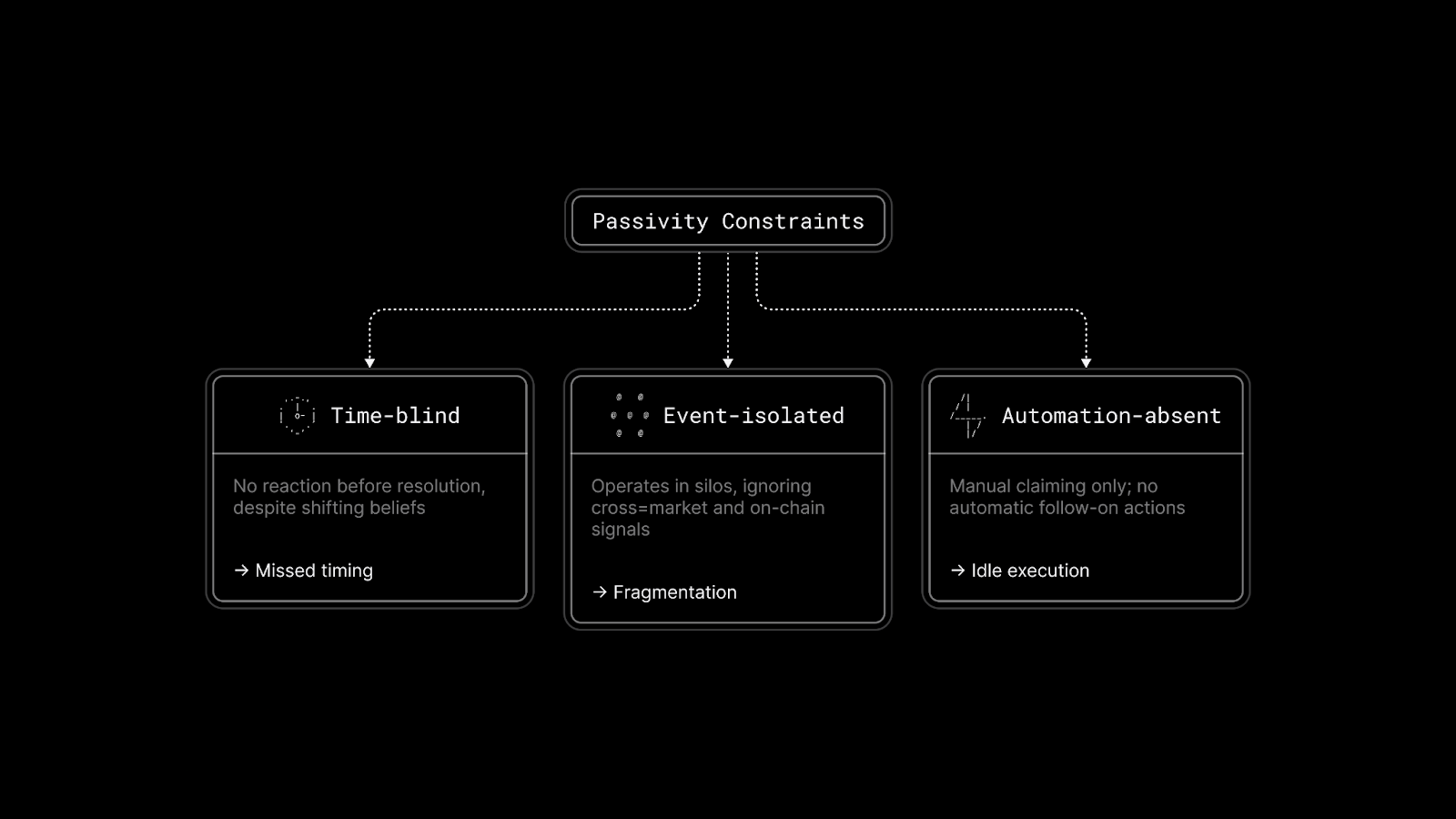

Limits of Passivity

Despite all their sophistication, most on-chain prediction markets share the same structural limitation: they are passive.

Traders express belief. Prices move. Probabilities sharpen. And then the system stops. Nothing reacts. Nothing adjusts. Nothing executes. Action is deferred until resolution, when uncertainty collapses into fact.

Prediction markets answer the question: What do people believe right now? They don’t answer the follow-up: What should the system do about it?

Probabilities as Live Signals

To see what is missing, it helps to rethink prediction markets. They are not betting venues or opinion polls. They are continuously updating probability oracles, backed by capital.

Every trade nudges a probability. Every price move reflects a change in collective belief. Every liquidity pool absorbs disagreement and uncertainty.

From this perspective, the most valuable moment is not resolution. It is the middle, when belief is forming, confidence is changing, and uncertainty is still alive. That is also the moment the system currently ignores.

Reactive Execution

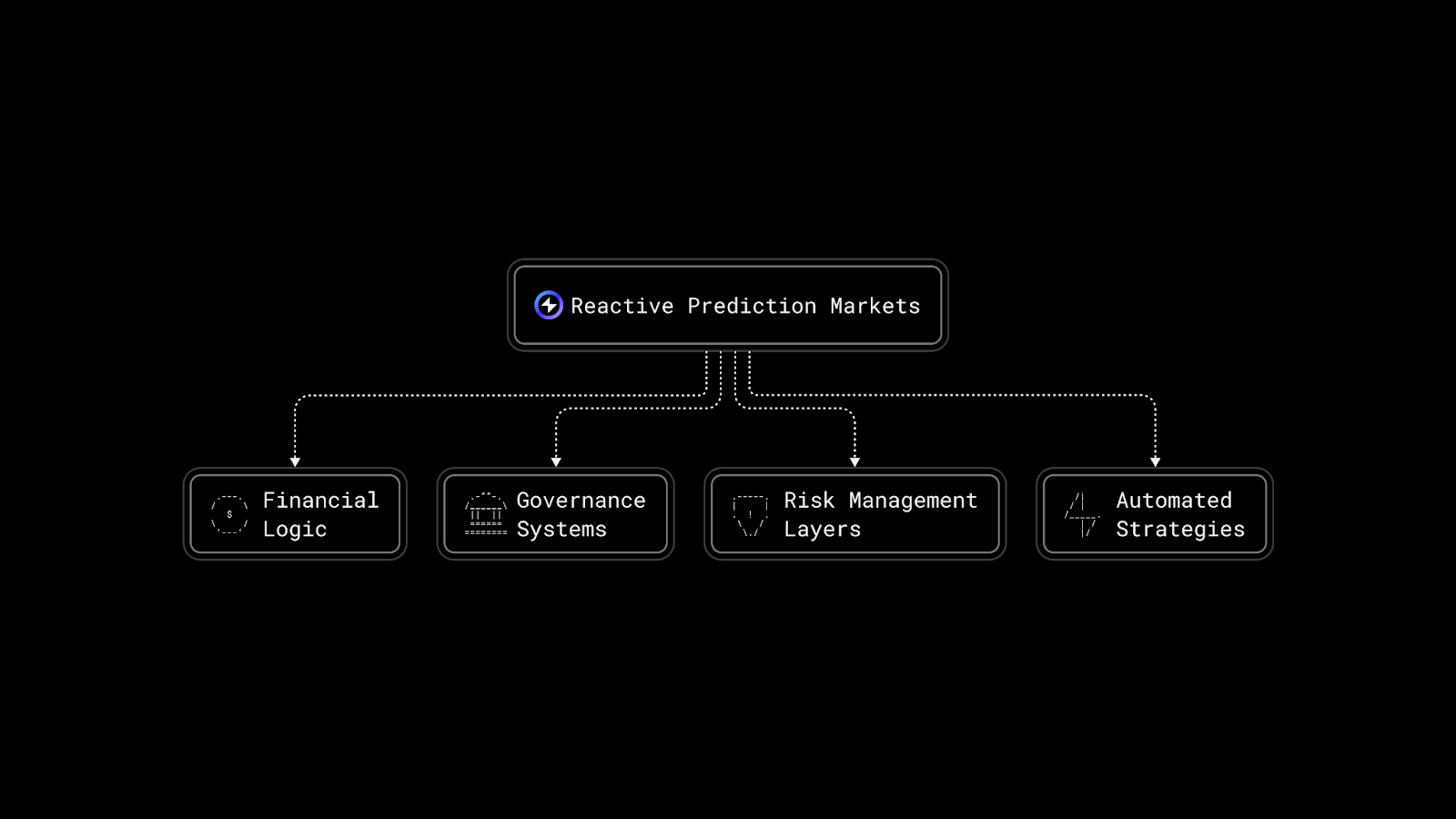

Reactive Contracts are built around an idea that on-chain logic should respond to events as they happen, not wait passively for external intervention. Instead of being called manually, a Reactive Contract listens. Instead of polling for changes, it reacts. Instead of executing once, it remains active.

This Reactive logic doesn’t need to live inside the prediction market protocol itself. It doesn’t require changing market rules, settlement mechanics, or oracle design.

Reactive Contracts operate at the user level as opt-in, autonomous execution strategies that individual users deploy on top of existing markets. The market continues doing what it already does best: aggregating belief into prices. The Reactive Contract interprets those prices and acts on the user’s behalf.

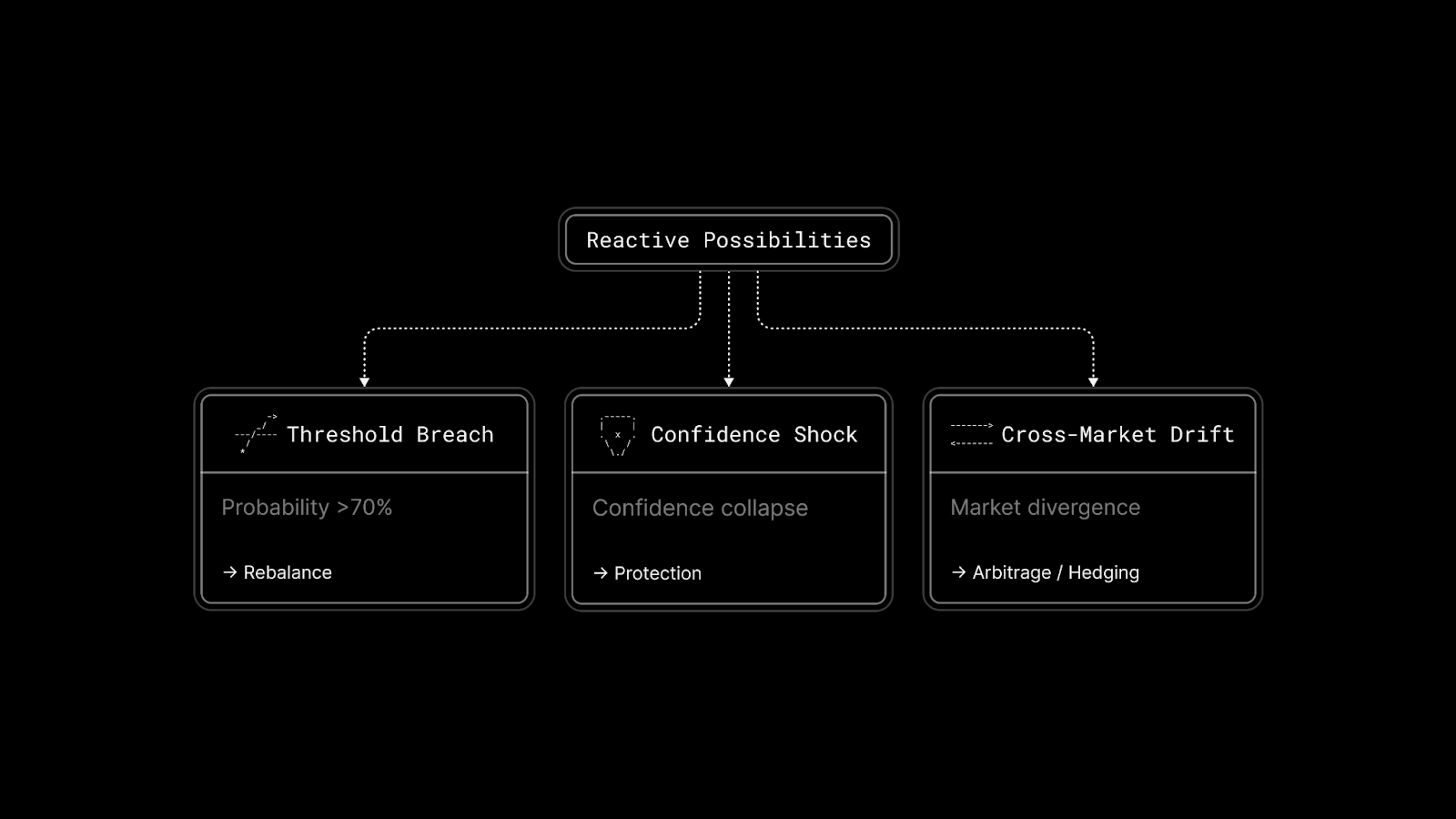

In this model, prediction markets remain neutral and passive by design. The reaction happens outside the protocol, where users define how their capital should respond to belief tweaks: rebalancing, hedging, arbitraging, or reallocating risk automatically as probabilities move.

When connected this way, probabilities stop being something to merely observe. They become something to act on, without waiting for resolution, governance changes, or human intervention.

None of this requires certainty. None of it requires protocol upgrades. The system reacts to belief in motion, purely through user-controlled automation.

Coordination Over Measurement

This is the key transition. Traditional prediction markets are excellent measurement tools. Reactive Contracts turn them into coordination primitives without turning markets into active agents themselves.

This is the key transition. Traditional prediction markets are excellent measurement tools. Reactive Contracts turn them into coordination primitives without turning markets into active agents themselves.

Instead of embedding execution logic into protocols, users deploy Reactive Contracts that:

- Subscribe to probabilistic signals

- Define personal thresholds and conditions

- Execute automated strategies when belief changes

The result is not prediction replacing decision-making, but prediction informing execution at machine speed, at the edge where users act, not at the core where markets must remain neutral.

Belief stops being descriptive and becomes operational.

Latency Risk

Most complex systems fail not because they lack information, but because they fail to act on it in time. Markets already tell us:

- When confidence is eroding

- When expectations flip

- When consensus breaks

Reactive Contracts allow on-chain systems to respond to those signals directly, without intermediaries, dashboards, or human latency. This is not about making markets “smarter.” It is about making systems responsive.

Markets as Inputs

In this combined model, prediction markets are no longer endpoints. They are inputs that feed belief into other systems.

They stop being passive observers of the future and become active participants in shaping present behavior. That paradigm switch from holding belief to acting on belief is what turns prediction markets from informational tools into infrastructure.

Closing Thought

Prediction markets taught us how to measure uncertainty. Blockchains taught us how to enforce rules without trust. Reactive Contracts answer the final question:

What happens when belief itself becomes an event?

When that happens, the most important moment is no longer resolution. It is reaction. And that is where prediction markets stop describing the world and start shaping it.

About Reactive Network

Reactive is an EVM-compatible execution layer for dApps built with Reactive contracts. These contracts differ from traditional smart contracts by using inversion-of-control for the transaction lifecycle, triggered by data flows across blockchains rather than by direct user input.

Reactive contracts listen for event logs from multiple chains and execute Solidity logic in response. They can determine autonomously when to transmit data to destination chains, enabling conditional cross-chain state changes. The network delivers fast and cost-effective computation via a proprietary parallelized EVM implementation.

Website | Blog | Twitter | Telegram | Discord | Reactive Docs

Build once — react everywhere!