ReacDEFI for On-Chain Stop Orders and Beyond

We're happy to introduce some major upgrades to what was the first app built on Reactive Network! ReacDEFI is a platform built to make decentralized finance automation truly accessible. By combining Reactive Smart Contracts with an intuitive no-code interface, it lowers the barriers that have long kept blockchain tools in the hands of developers alone. Whether you’re guarding your portfolio against sudden downturns or fine-tuning yield farming strategies, ReacDEFI delivers these capabilities through its interface that anyone can understand and use.

The app introduces stop orders to decentralized exchanges. A stop order automatically sells your tokens when the price falls below your chosen threshold, protecting investments 24/7 without requiring constant monitoring.

ReacDEFI prototype initially won our Reactive Hackathon a year ago. After that, the winners of the hackathon received developer grants from Reactive Network and continued building, turning their idea into a live application. So, this is not only the first app built on Reactive Smart Contracts, but also an inspirational story of collaboration and growth.

The platform is launching first on Base Mainnet, with additional chain integrations on the horizon.

Stop Orders Today, Liquidation Protection Tomorrow

The first version of ReacDEFI allows users to set up stop-loss orders directly on Uniswap pools. This means traders can finally automate strategies that were once only possible via centralized solutions. In future updates, ReacDEFI will expand to other DEXes and introduce liquidation protection for Aave, giving DeFi users even more ways to protect and optimize their positions.

For specific inquiries about pool integrations or any other questions, users are encouraged to reach out in the ReacDEFI Telegram channel.

Why On-Chain Protection Changes the Game

Until now, stop orders were almost exclusively a feature of centralized exchanges. By bringing them on-chain, ReacDEFI bridges a major gap between CEX and DEX functionality. This marks the first consumer-facing app built with reactive contracts, proving the practical value of the Reactive Network in real-world use cases.

The story behind the app also highlights accessibility. Early prototypes were built during a Reactive Hackathon by beginner developers, independent of the main Reactive team. This demonstrates just how approachable Reactive Smart Contracts are — even newcomers to blockchain development can create sophisticated automation tools. After receiving builder grants from Reactive Network, these developers were later brought on to advance the development of ReacDEFI and contribute to other use cases.

Under the Hood

Using the app begins with connecting your wallet. From there, ReacDEFI deploys two contracts on your behalf:

- a Reactive Smart Contract that continuously monitors market prices, and

- a callback contract that executes the swap once your chosen price condition is met.

The callback contract is approved with the tokens you want to trade, while the Reactive Smart Contract keeps a small balance to cover gas fees. Together, they create an autonomous trading setup that works in the background around the clock.

Create a Stop Order

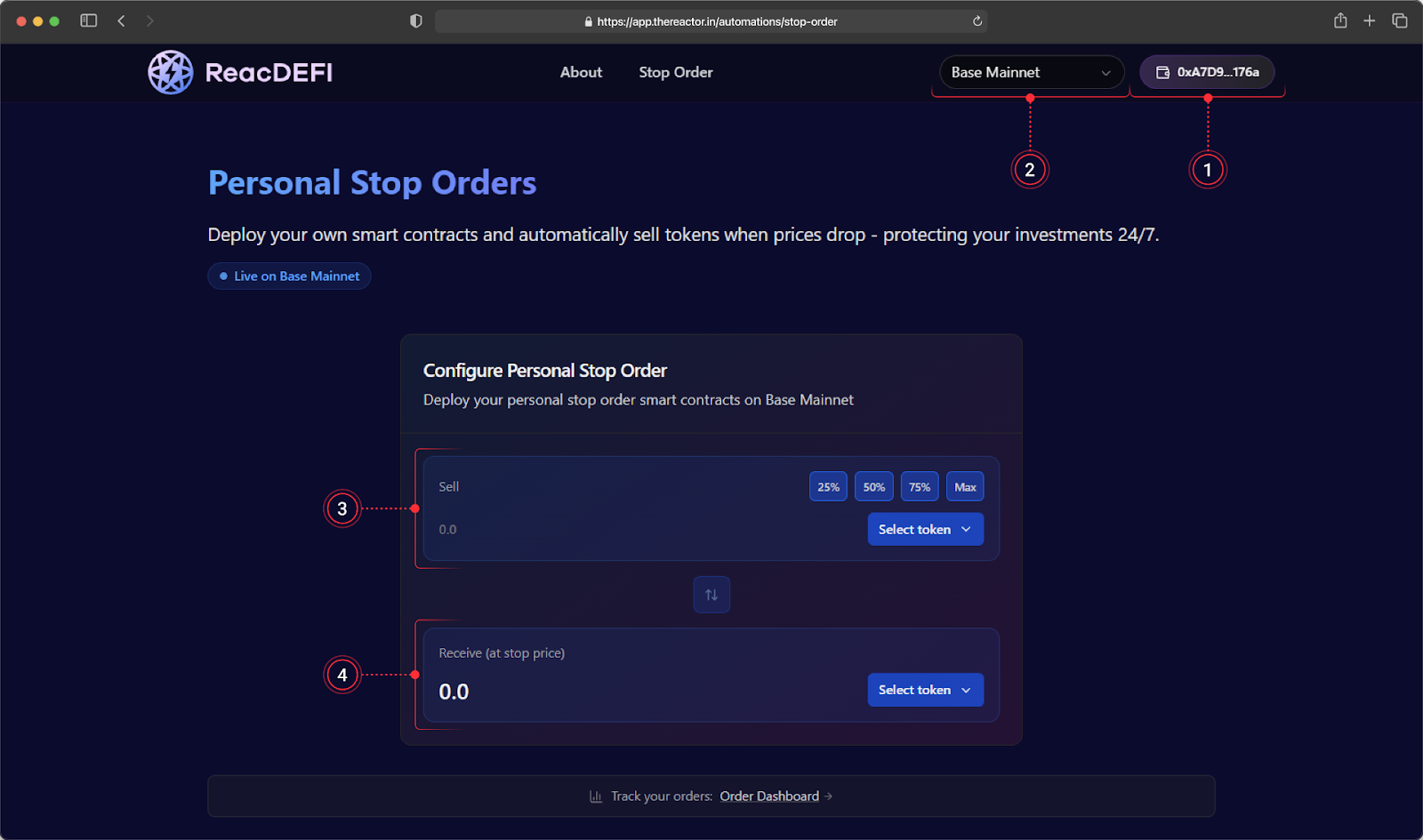

The interface is designed to keep the process simple and straightforward:

- Visit ReacDEFI and connect your wallet.

- Make sure Base Mainnet is selected in the network tab.

- Choose the token you want to sell (e.g., USDC) and specify the amount.

- Select the token you want to receive and set your desired stop price.

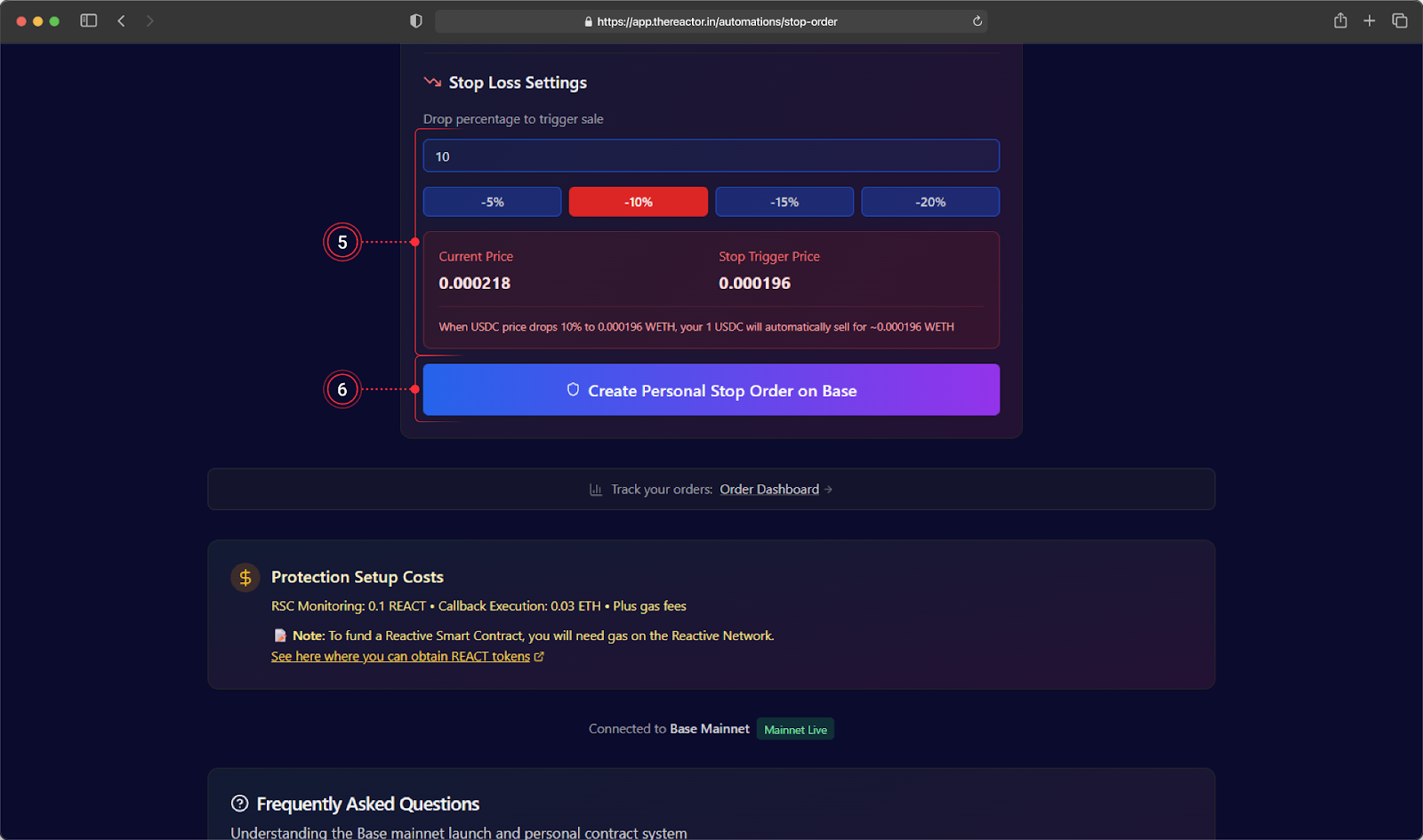

- Define the percentage drop that will trigger the sale, and review the red information box for details.

- Press Create Personal Stop Order on Base to confirm.

Recap

ReacDEFI represents a major step forward in making DeFi tools usable for everyday traders. It takes features once confined to centralized exchanges — such as stop-loss orders — and reimagines them for decentralized, permissionless markets. The app proves the value of Reactive Smart Contracts, both in terms of technical capability and accessibility, and sets the stage for future features like liquidation protection.

By launching with a clean interface and no-code setup, ReacDEFI opens the door for anyone to automate their strategies, not just seasoned developers. In doing so, it makes Defi more secure, reliable, and user-friendly.

About Reactive Network

The Reactive Network, pioneered by PARSIQ, ushers in a new wave of blockchain innovation through its Reactive Smart Contracts (RSCs). These advanced contracts can autonomously execute based on specific on-chain events, eliminating the need for off-chain computation and heralding a seamless cross-chain ecosystem vital for Web3’s growth.

Central to this breakthrough is the Inversion of Control (IoC) framework, which redefines smart contracts and decentralized applications (DApps) by imbuing them with unparalleled autonomy, efficiency, and interactivity. By marrying RSCs with IoC, Reactive Network is setting the stage for a transformative blockchain era, characterized by enhanced interoperability and the robust, user-friendly foundation Web3 demands.

Website | Blog | Twitter | Telegram | Discord | Docs