ReacDEFI for On-Chain Stop Orders and Beyond

We’re excited to roll out ReacDEFI v2, the latest version of the first app built on Reactive Network. This release brings a fresh new design, smoother flows, and ongoing on-chain automation improvements.

ReacDEFI is built to take the hassle out of DeFi risk management. By pairing Reactive Contracts with a clean, no-code interface, it lets users set up advanced trading logic without digging into smart contract code. Whether you’re trying to lock in profits, cut losses, or simply step away from the charts, ReacDEFI has your back, running quietly in the background 24/7.

What’s new

Design

In v2 we significantly rebuilt the UI. It loads faster, navigation is simpler, and it’s easier to see what you’re about to create before you sign. The new glass-style design is not just cosmetics, it helps keep the screen readable when you’re setting numbers and conditions.

Take Profit Orders

Take-profit orders are now a first-class thing in ReacDEFI. The key point: it works both ways, not only as “protection when it goes down”. You can set an exit for profit targets the same way you set a stop-loss, which is how people actually manage positions.

With v2 now live, ReacDEFI supports:

- Stop-loss orders

- Take-profit orders

Both are executed fully on-chain, directly on Uniswap pools. You set the rules once, and ReacDEFI takes it from there: watching prices, waiting for conditions to line up, and triggering swaps the moment they do.

Continuous Progress

What is the most important thing is that ReacDEFI is actively maintained. It is really great to see an application built on Reactive Contract grow and evolve. v2 is not a “one-off redesign” it’s another step in the roadmap, with liquidation protection and more integrations coming next. If you tried v1 and left, v2 is worth another look because the product moved forward.

Liquidation protection smart contracts are ready, UI for them will be added in the next version. So, ReacDEFI will soon help users shield their lending positions from getting wiped out during sudden market moves.

The app is currently live on Base Mainnet, with more chains and integrations lined up ahead.

Under the Hood

Once you connect your wallet, ReacDEFI spins up the contracts needed to automate your order:

- a Reactive Contract that keeps an eye on price movements, and

- a Callback Contract that executes the swap when your conditions kick in.

The callback contract is approved to swap your tokens on your behalf, while the Reactive Contract holds a small balance to cover gas. Together, they handle the entire flow with no manual intervention required.

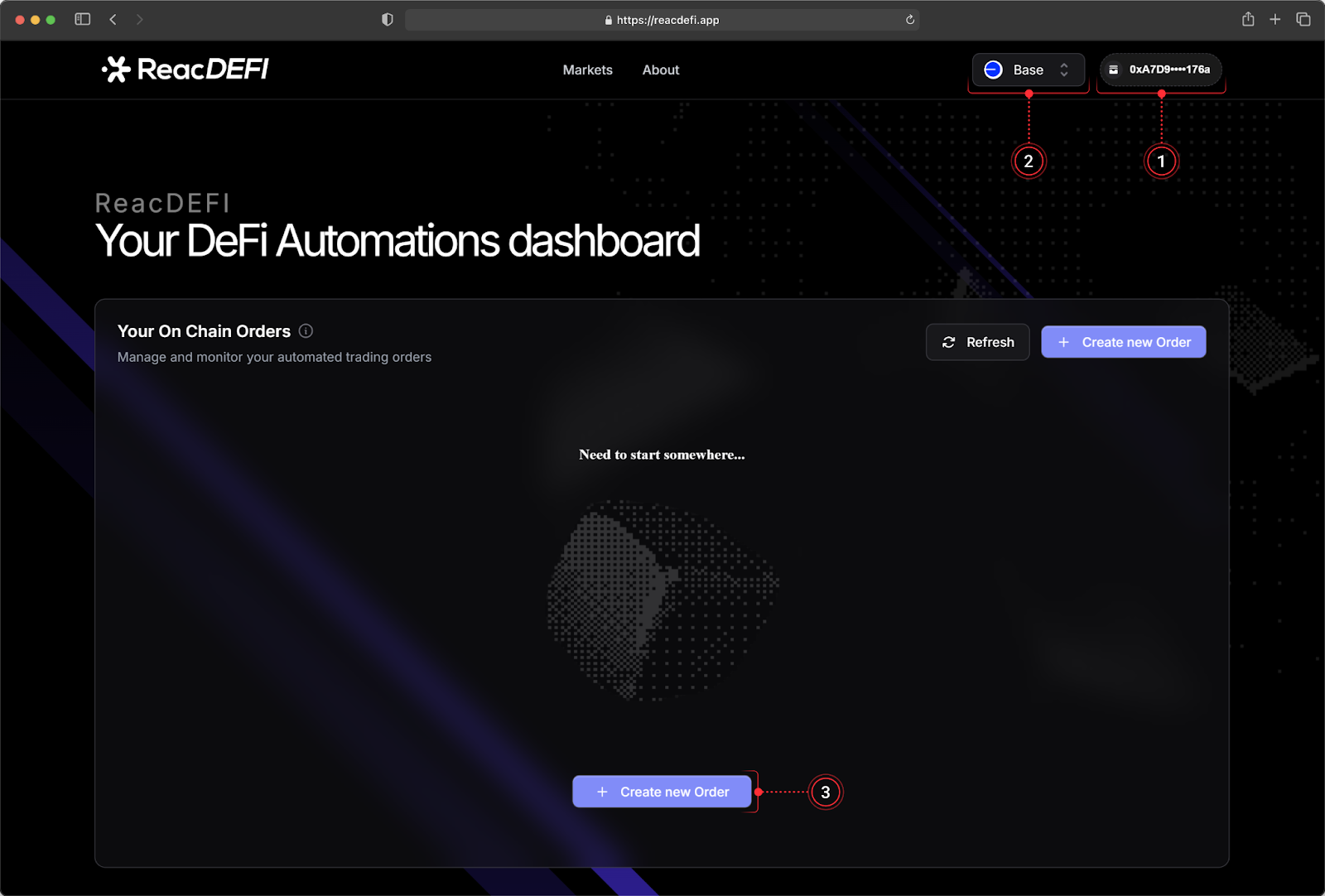

Create a Stop-Loss / Take-Profit Order

- Head to ReacDEFI and connect your wallet.

- Switch to Base Mainnet.

- Click + Create new Order.

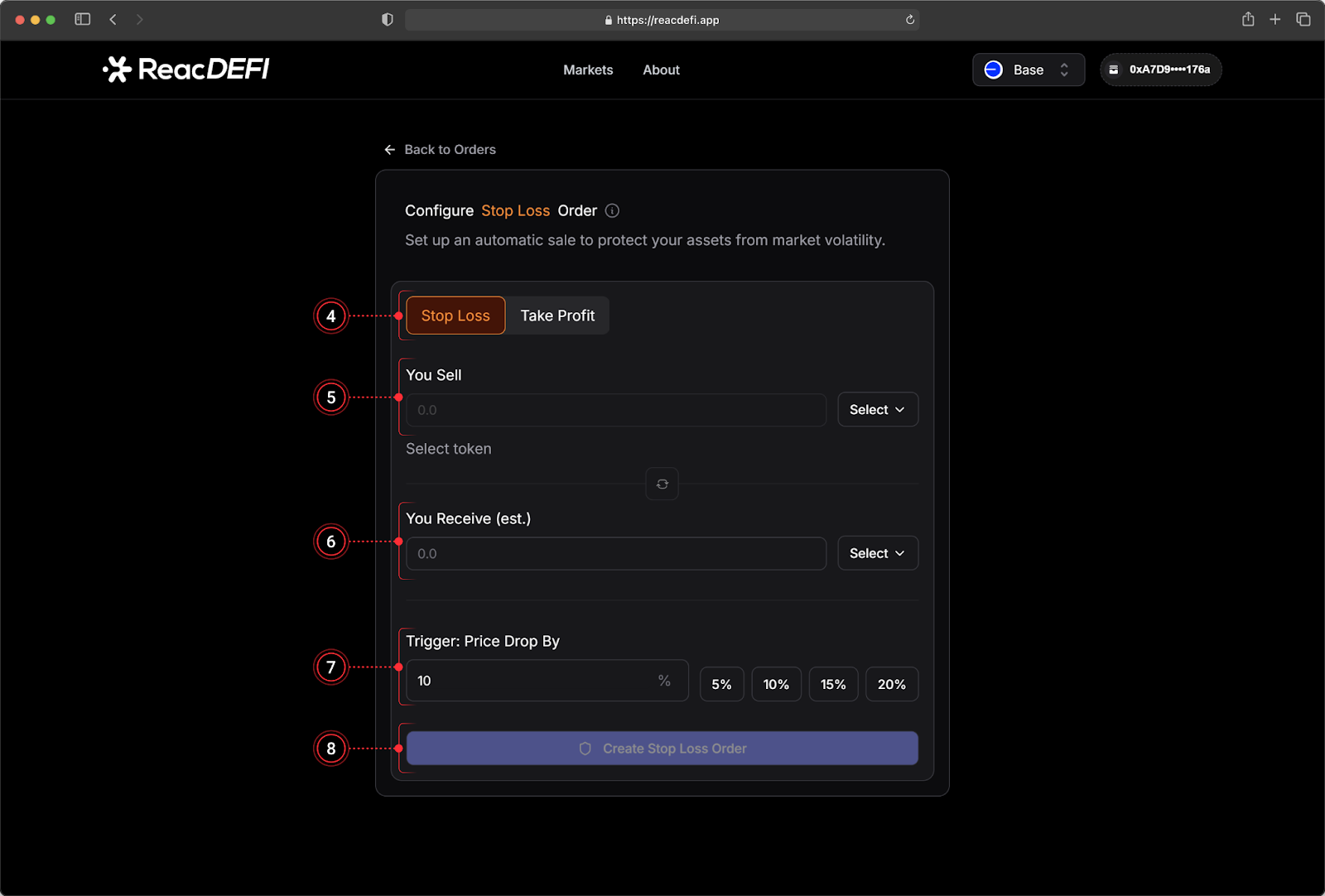

- Select either Stop Loss or Take Profit.

- Pick the token you want to sell and enter the amount.

- Choose the token you want to receive and type in the amount.

- Set your stop-loss or take-profit price and review the details shown on screen.

- Press Create Stop Loss Order or Create Stop Loss Order.

After confirming the transaction, your order is live and watching the market for you.

Coming Up

Development on ReacDEFI doesn’t stop with v2. The roadmap ahead includes:

- Liquidation protection for lending protocols (starting with AAVE)

- Expanded DEX and pool support

- Further UX and performance improvements

If you have questions, feature requests, or want to suggest new integrations, the team is easy to reach in the ReacDEFI Telegram channel.

In Short

ReacDEFI v2 brings on-chain automation another step closer to everyday usability. With stop-loss and take-profit orders now live, a refreshed interface, and liquidation protection around the corner, it’s shaping up to be a practical safety layer for DeFi users who don’t want to stare at charts all day.

Set it up, let it run, and get on with everything else.

About Reactive Network

Reactive is an EVM-compatible execution layer for dApps built with Reactive contracts. These contracts differ from traditional smart contracts by using inversion-of-control for the transaction lifecycle, triggered by data flows across blockchains rather than by direct user input.

Reactive contracts listen for event logs from multiple chains and execute Solidity logic in response. They can determine autonomously when to transmit data to destination chains, enabling conditional cross-chain state changes. The network delivers fast and cost-effective computation via a proprietary parallelized EVM implementation.

Website | Blog | Twitter | Telegram | Discord | Reactive Docs

Build once — react everywhere!