Reactive Staking: Phase Three

Phase Two of Reactive Staking is coming to a close, with the 90-day pool set to unlock at block 2,267,991 (around September 8th, 00:23 UTC). So far, over 100 million REACT has been staked during this phase, delivering an average APY of 12.5%.

Next up is Phase Three, which will carry forward the same structure as Phase Two:

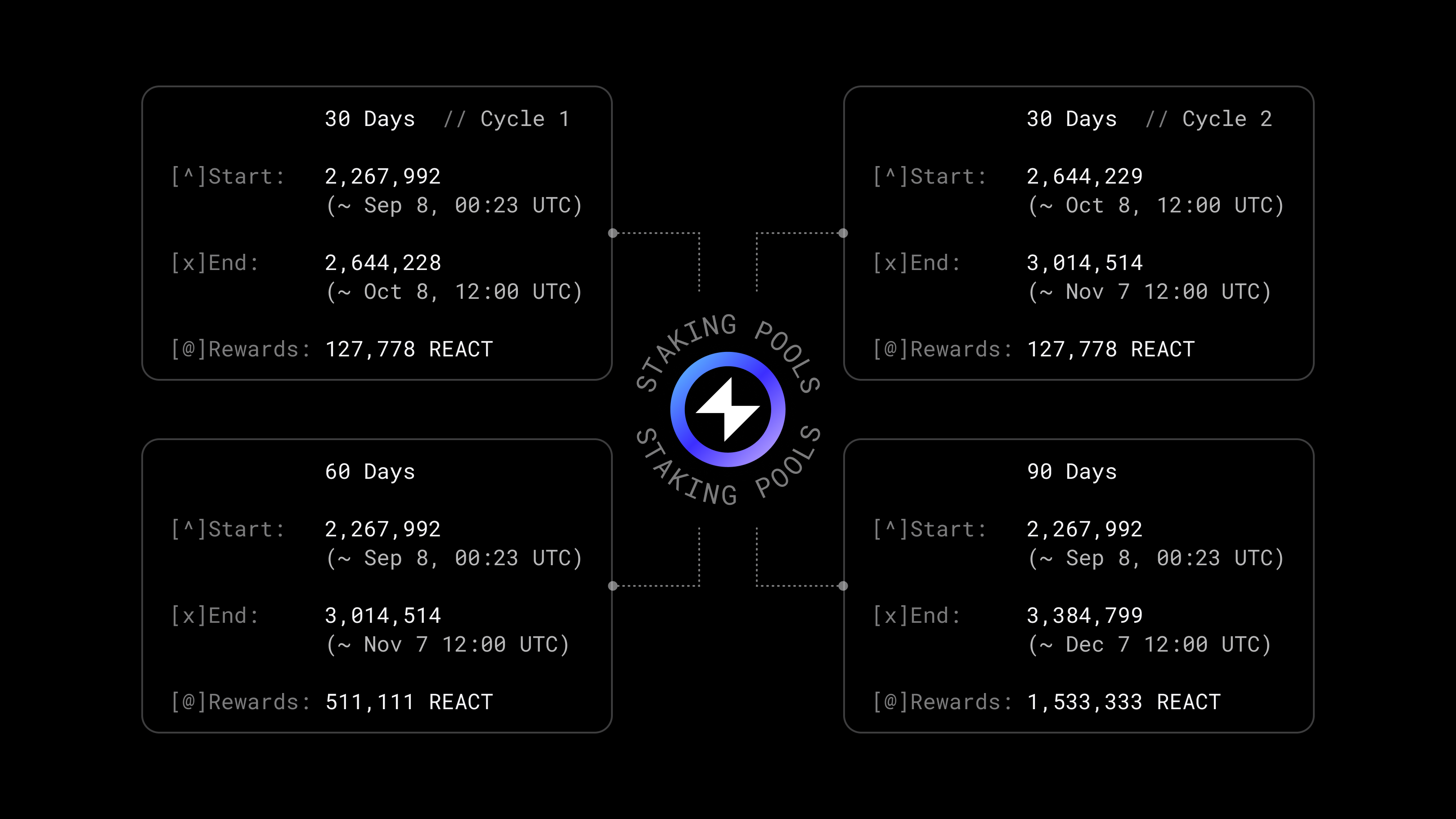

- Four pools: 30 days [Cycle 1], 30 days [Cycle 2], 60 days, and 90 days.

- Each pool will receive different reward allocations from a shared reward pool.

Phase One & Phase Two Retrospective

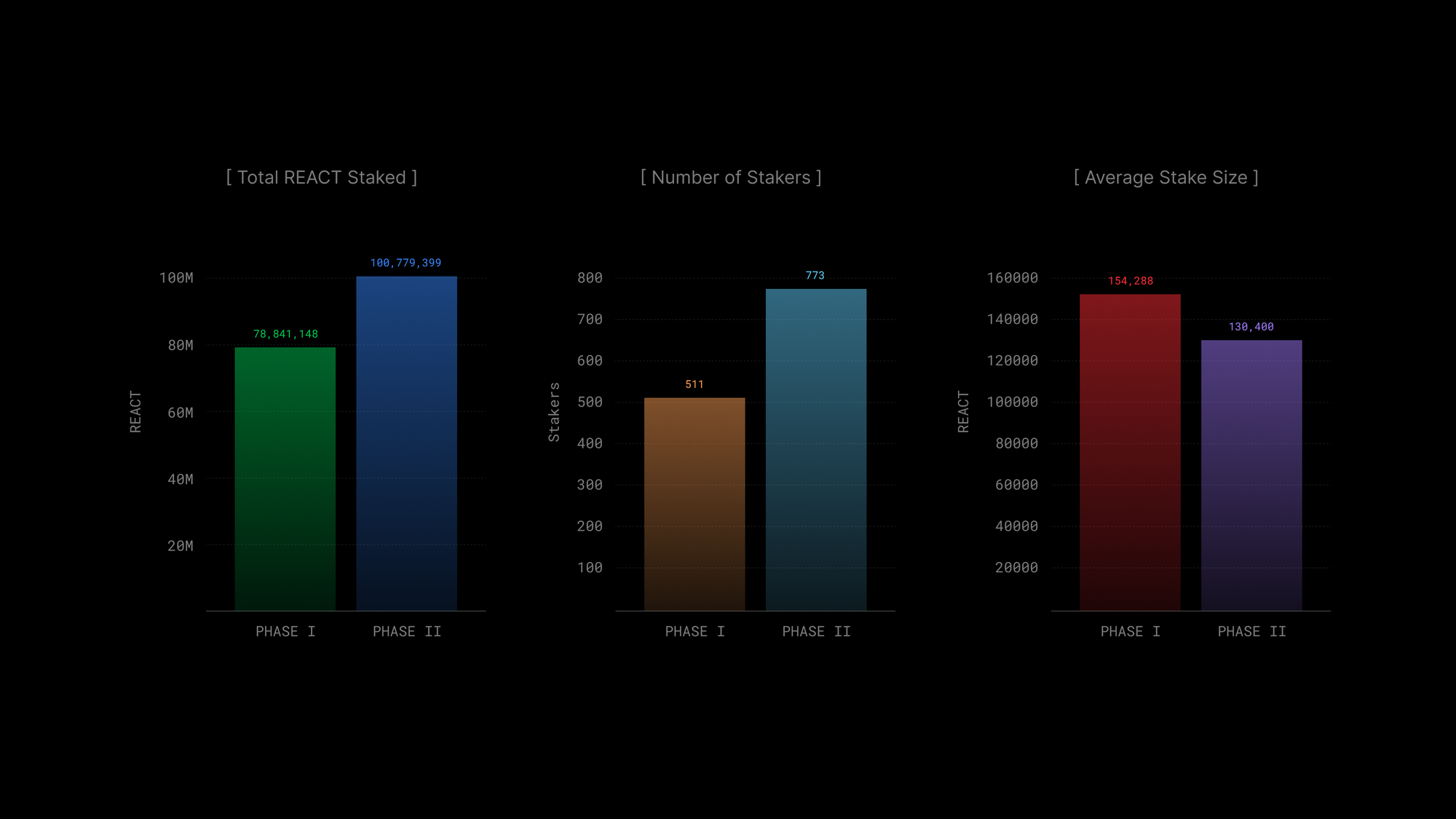

The second phase of staking marked a step forward in terms of overall engagement. Both the total amount staked and the number of participants rose significantly. The one parameter that declined was the average stake size, but this is better read as a positive signal: with more users joining in Phase Two, the distribution of capital became broader and less concentrated.

Another important factor to consider is structural design. Phase One operated with a single 90-day pool, which naturally concentrated stakes into larger commitments. Phase Two introduced four pools with different lock-up periods. This flexibility not only attracted more participants but also spread the capital across varying strategies, from short-term cycles to long-term commitments.

Close-up in Phase Two

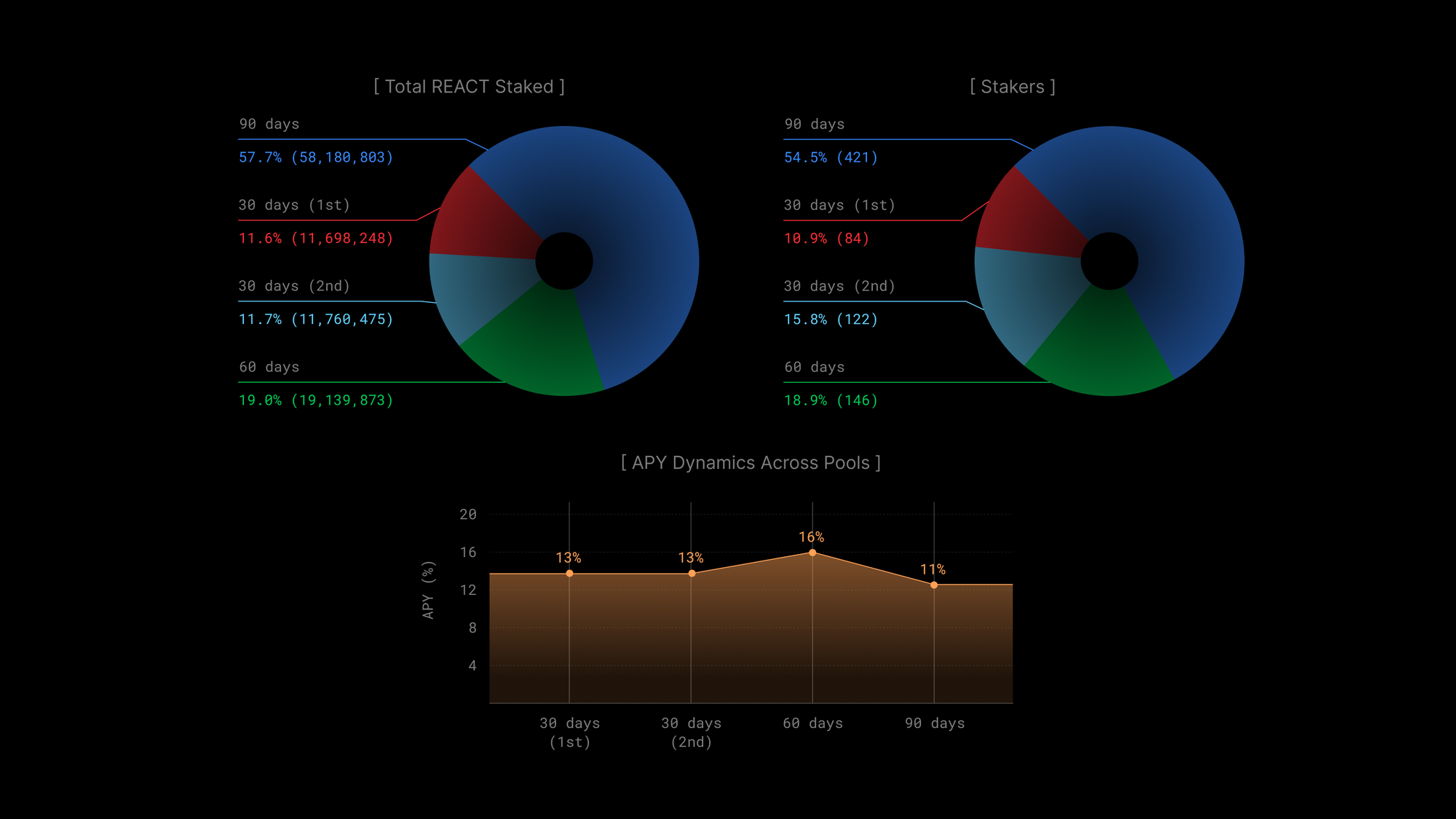

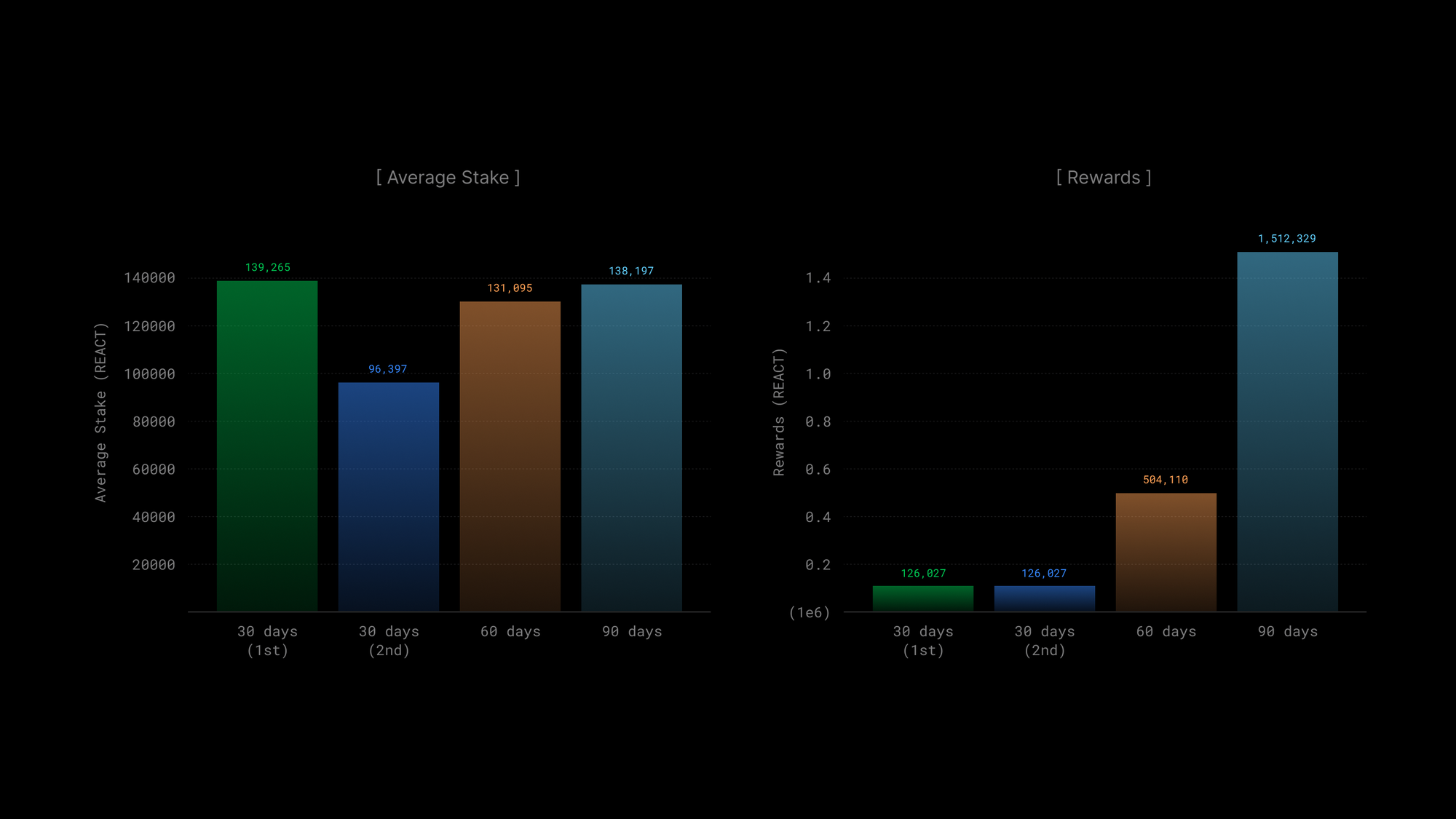

The distribution of stakers and capital across pools suggests a clear trade-off between yield and commitment. Shorter pools offered higher APYs — peaking at 16% in the 60-day pool — but attracted less overall capital. This is expected: higher yields act as an incentive to offset lower lock-up periods, yet most participants still preferred the security of the 90-day pool, which gathered over half the total stake despite offering the lowest APY.

When looking at rewards, the correlation with pool length becomes clearer. Larger pools with longer commitments naturally concentrated the majority of rewards, not because of higher rates, but because of sheer volume of REACT locked in. Conversely, the shorter pools produced modest reward totals, reflecting their smaller share of staked assets, even with boosted APYs.

Average stake size adds another layer to the story. The shorter cycles attracted a mix of strategies: some participants allocated significant amounts to test quick rotations, while others entered with smaller stakes to keep flexibility. By contrast, both the 60- and 90-day pools show consistently higher average stakes, suggesting that longer commitments appealed more to larger holders seeking predictable returns.

Altogether, Phase Two demonstrates how pool design shapes behavior: short-term options encouraged tactical staking, but long-term pools remained the anchor of liquidity, ensuring both breadth of participation and depth of capital.

Phase Three in Detail

Staking in Phase Three follows the same pool structure as Phase Two. When you stake REACT, your tokens are locked, and you receive staking tokens that represent your share of the pool. At the end of the lock period, these can be redeemed for your principal plus proportional rewards.

Because rewards are shared dynamically, APY fluctuates: more participants reduce individual yields, fewer participants increase them. Based on prior trends, APY is expected to average 12–20% in 2025.

Here are the approximate schedules and rewards for Phase Three staking pools:

How to Join

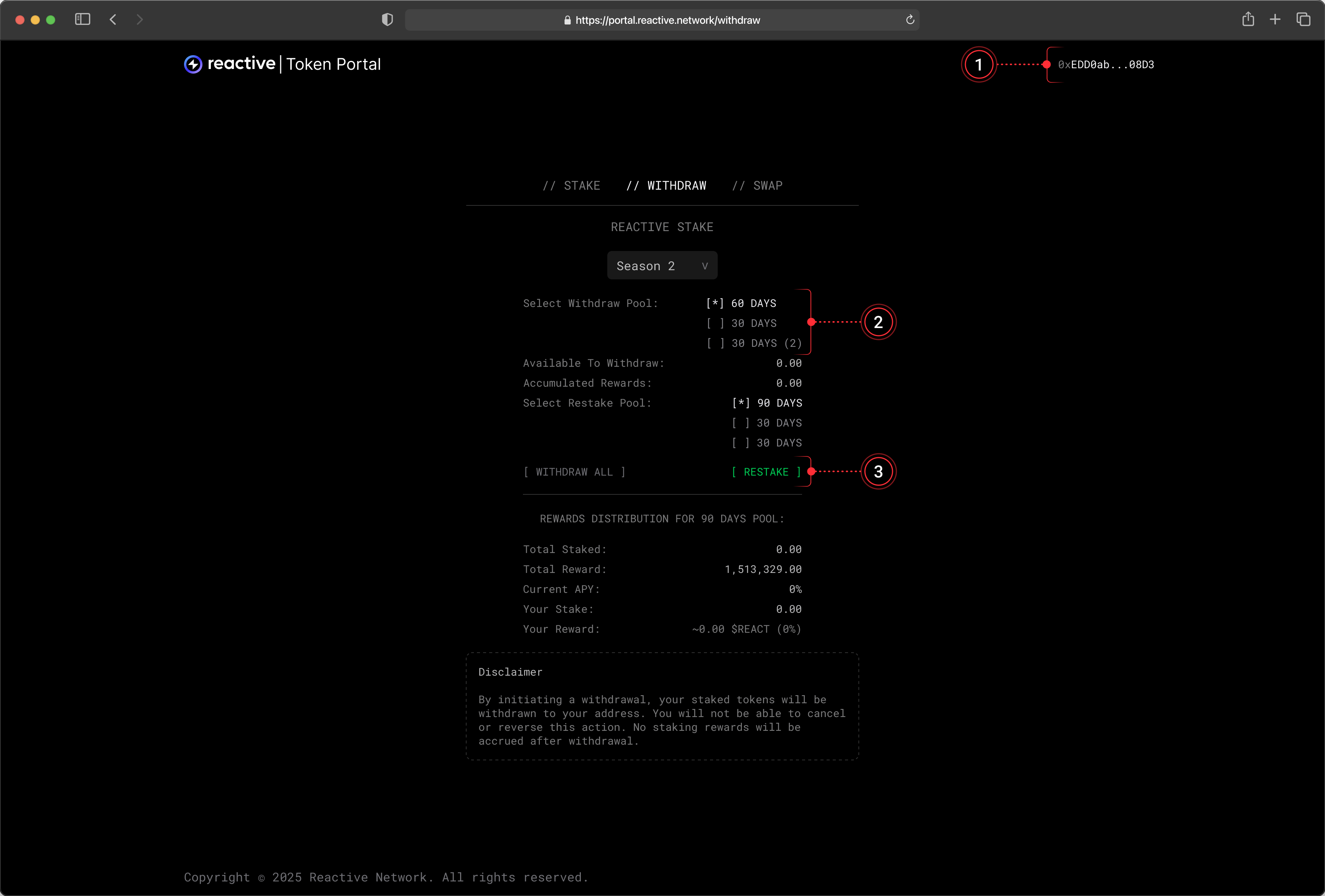

For Phase Two stakers:

- Go to the Reactive Token Portal and check your REACT wallet is connected.

- Choose the pool where your stake is.

- Select Restake and confirm the transaction to move into Phase Three.

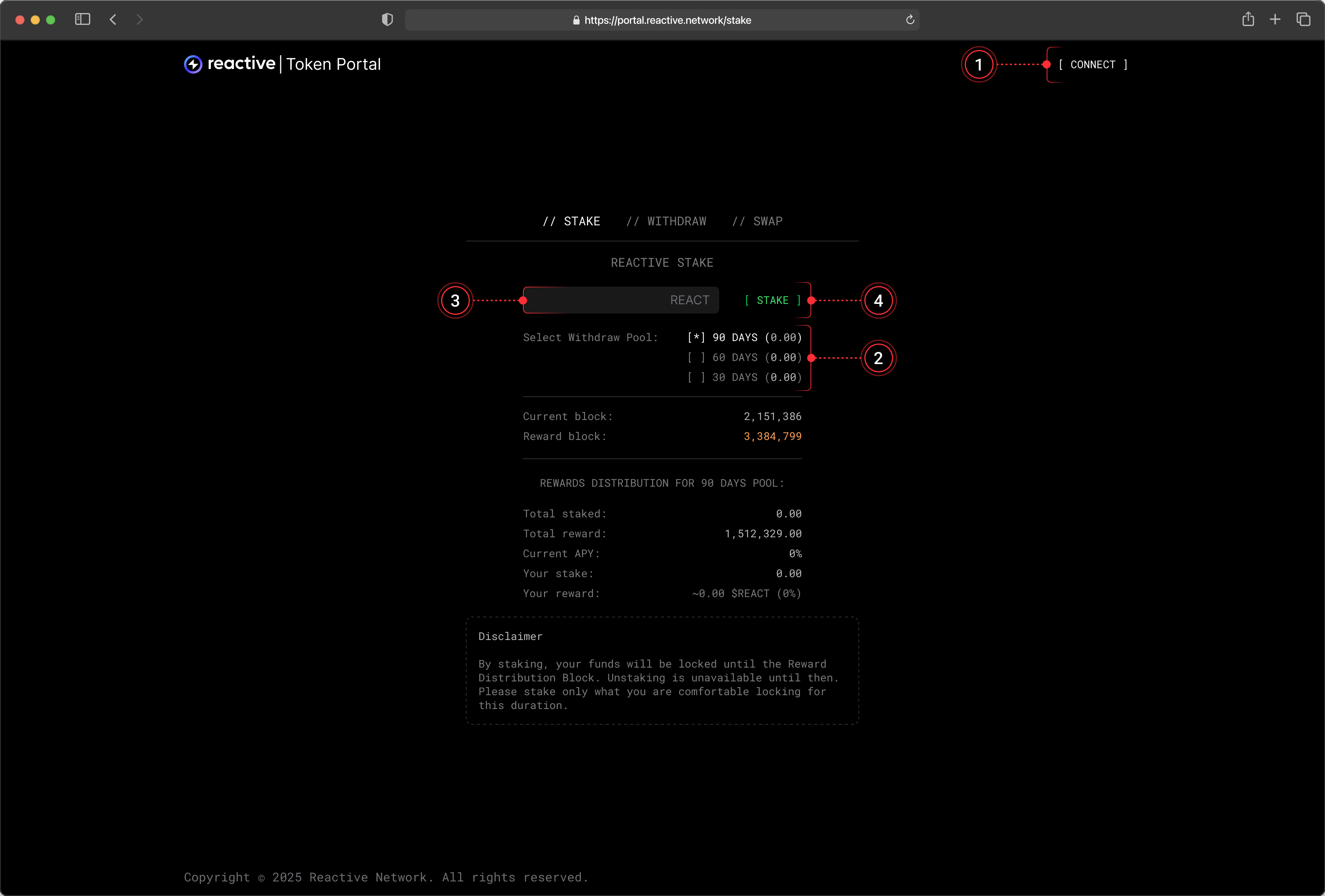

For new participants:

- Go to the Reactive Token Portal and connect your REACT wallet.

- Choose a pool (30, 60, or 90 days).

- Enter the amount you want to stake.

- Select Stake and confirm the transaction.

Once staked, your REACT remains locked for the full duration of the chosen pool. Rewards and principal become available only after the pool ends.

Recap

Phase Two will close at block 2,267,991 (around September 8th, 00:23 UTC). Remember: rewards are not automatic and must be claimed through the Reactive Token Portal.

Immediately after, Phase Three begins, offering three pools open to both returning and new stakers:

- 30 days (two consecutive cycles)

- 60 days

- 90 days

This new phase brings a fresh 2.3M REACT reward pool, with projected APYs of 15–20%, continuing to encourage active participation in the Reactive Network.

For technical details on wallet setup and staking mechanics, visit Reactive Docs.

For more details on tokenomics, explore REACT Tokenomics & Staking.