Reactive Staking: Season Four

Another staking season is winding down. The 90-day pool unlocks at block 3,384,799 on December 7th, wrapping up a season where more than 121 million REACT were staked and participants earned an average 11.44% APY.

Now it’s time to shift our gaze toward Season 4, which brings a slightly refreshed structure. Instead of four pools, we’re rolling with three: 1 month, 2 months, and 3 months. Each comes with its own slice of the reward pie, all drawn from a shared pool — same system as before, just cleaner and easier to navigate.

Retrospective

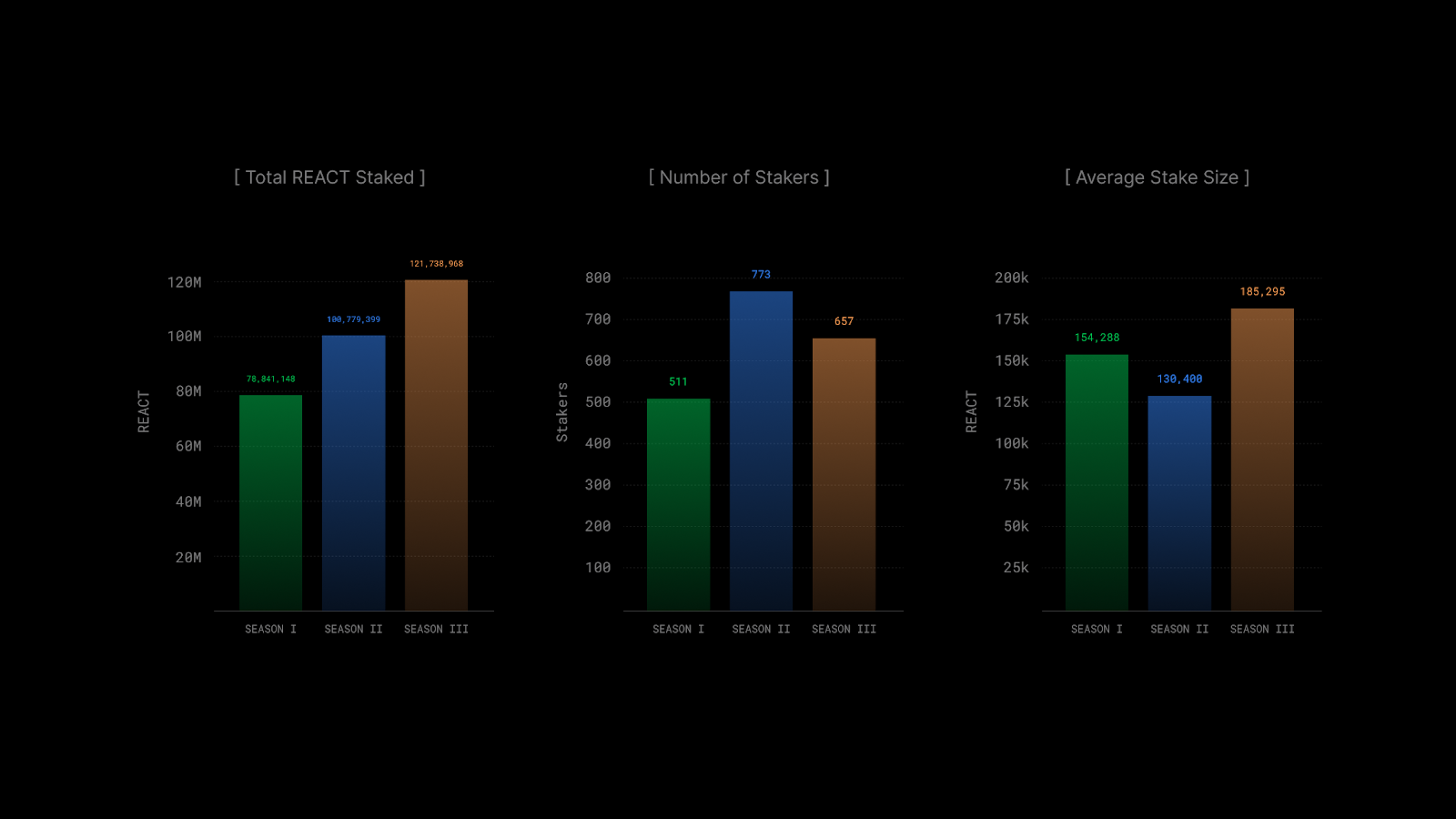

Season 3 kept the momentum alive. Total REACT staked hit an all-time high, and overall participation stayed strong: comfortably above Season 1 and trailing only slightly behind the record breaker that was Season 2. Interestingly, while Season 3 brought in fewer stakers than Season 2, the average stake size jumped, showing that those who participated leaned in more heavily.

Pool design has played a defining role in how each season has unfolded. Season 1 offered a single 90-day pool, which funneled everything into long-term commitments. Season 2 shook things up by introducing four pools of different lengths, sparking a surge in participation and opening the door to more creative staking strategies. Season 3 built on that flexibility and still managed to attract more total capital. This may be considered clear evidence that variety fuels both broader participation and deeper engagement.

Closer Look at Season Three

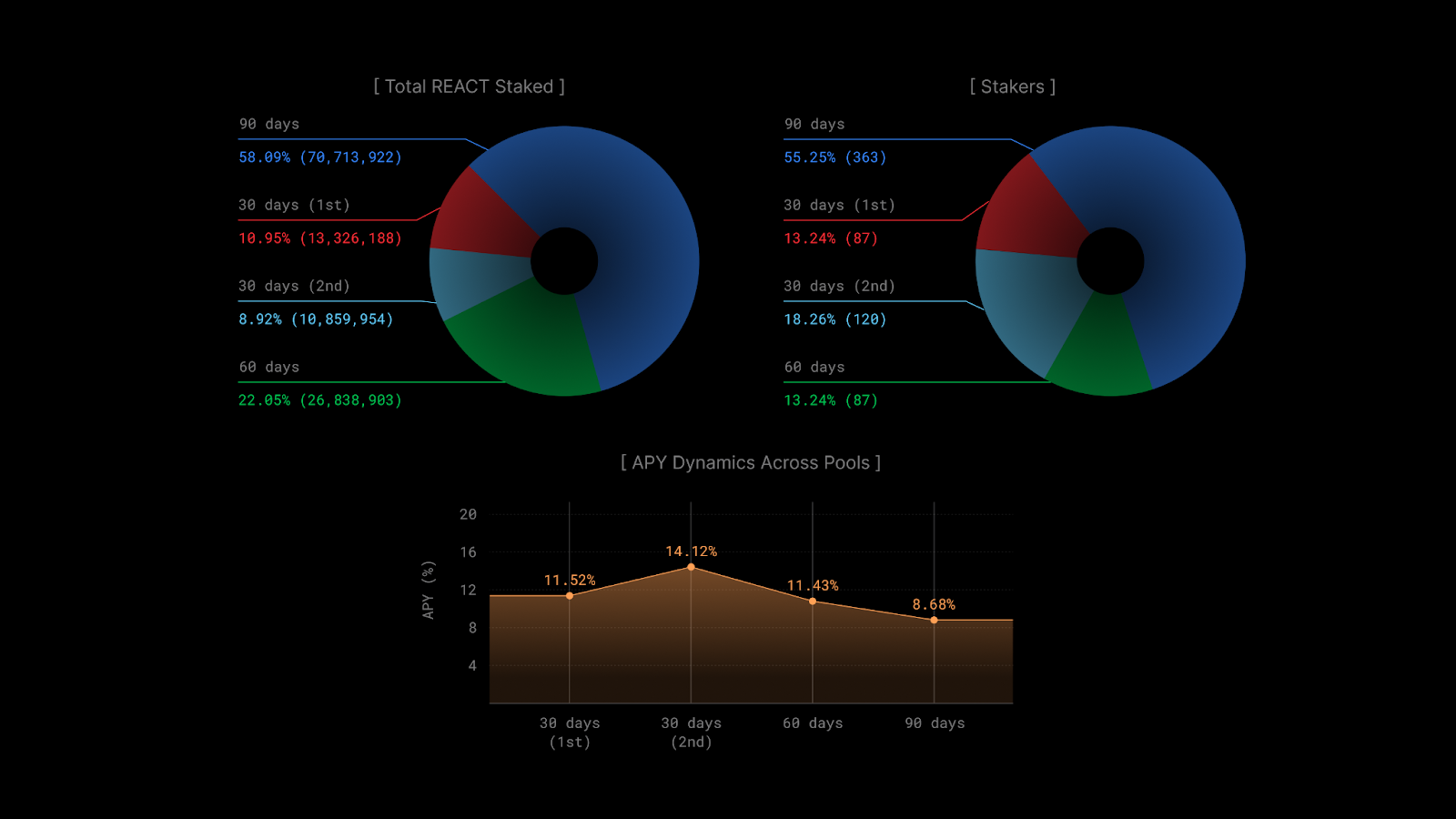

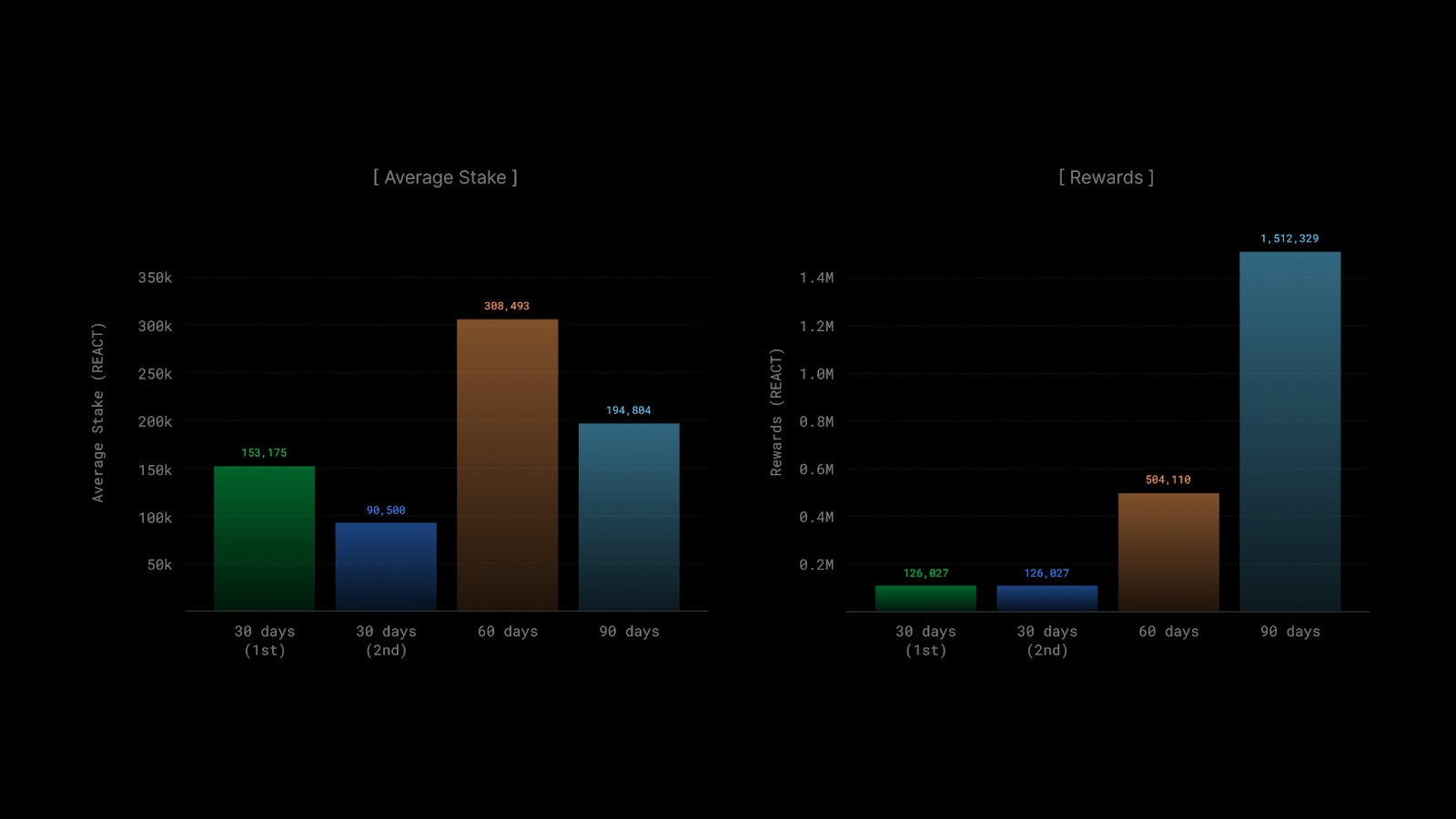

The mix of pools in Season 3 struck a balance between flexibility and commitment. The shorter pools dangled higher APYs but didn’t attract much capital. The 90-day pool, on the other hand, maintained its status as the fan favorite, absorbing more than half of all staked REACT despite offering the lowest rate.

Rewards flowed along predictable lines. Longer pools walked away with the lion’s share simply because they carried the most REACT, while shorter pools, even with higher APYs, produced smaller totals due to lighter staking.

Average stake sizes add another layer to the story. The 30-day pools drew a mix of small and mid-size positions, perfect for quick-cycle players. The 60- and 90-day pools housed larger, more stable stakes, showing that when participants commit, they tend to commit with size.

Season Four in Detail

Season 4 preserves the core mechanics. When you stake REACT, your tokens are locked, and you receive pool-specific staking tokens that track your share. Once the lock ends, you redeem them for your original stake plus your portion of the rewards.

Because rewards are dynamic and proportional, APY isn’t fixed. More stakers push yields down; fewer stakers push them up. Based on past seasons, expected APY in 2025 should hover around 10–15%.

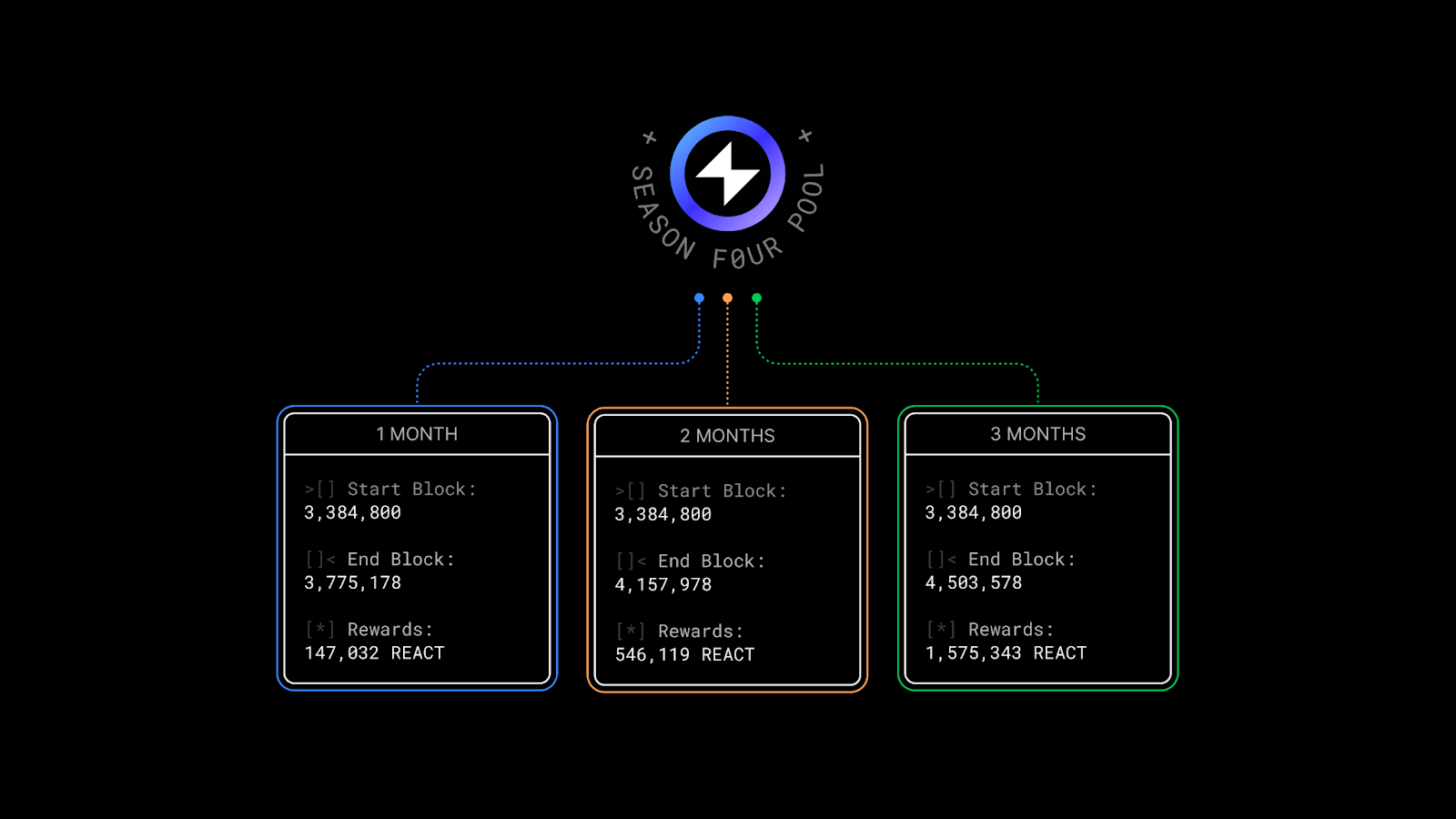

Approximate schedules and reward allocations for Season 4:

How to Join

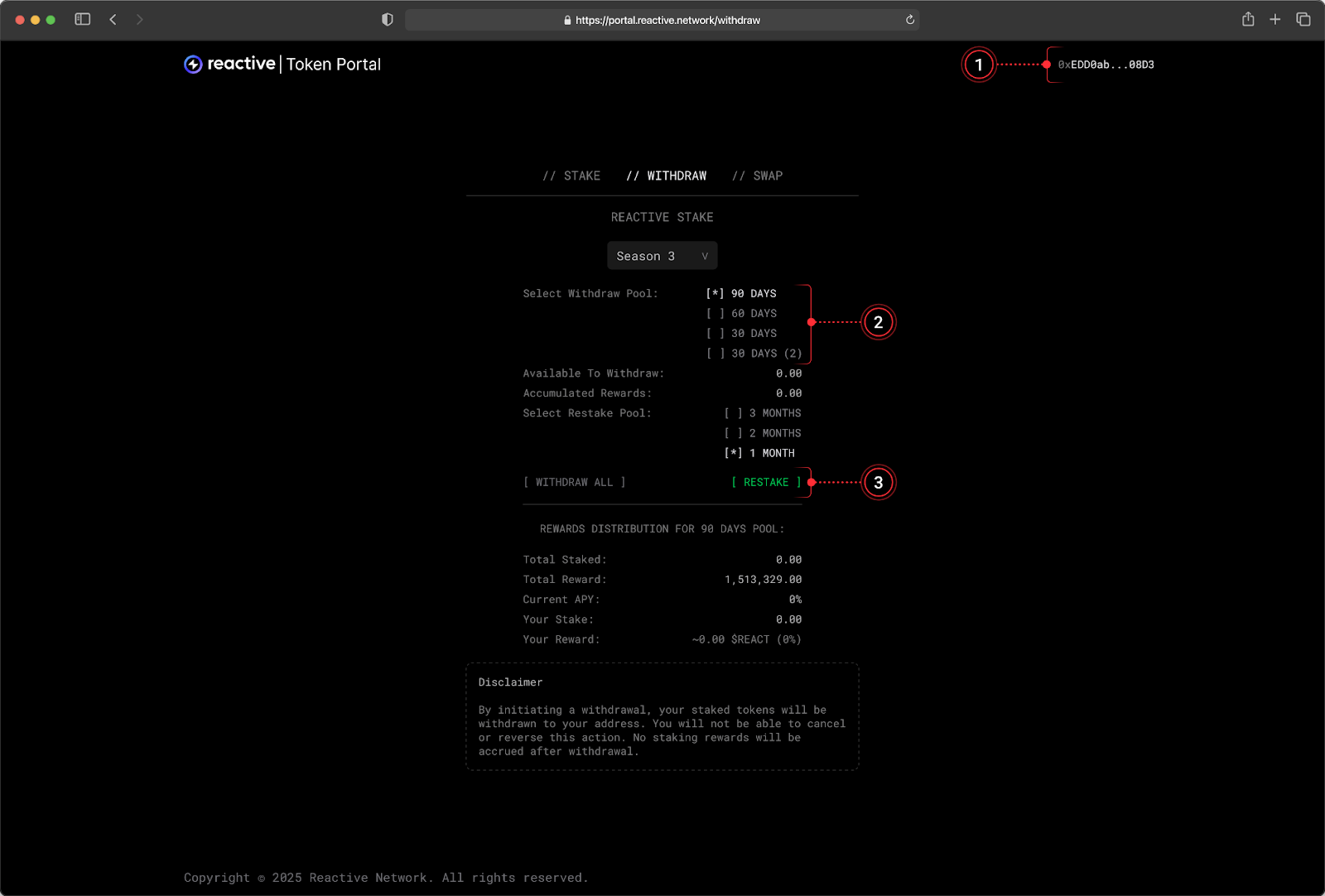

For Season 3 stakers:

- Open the Reactive Token Portal and check your REACT wallet is connected.

- Select the pool you’re currently in.

- Hit Restake and confirm the transaction to roll into Season 4.

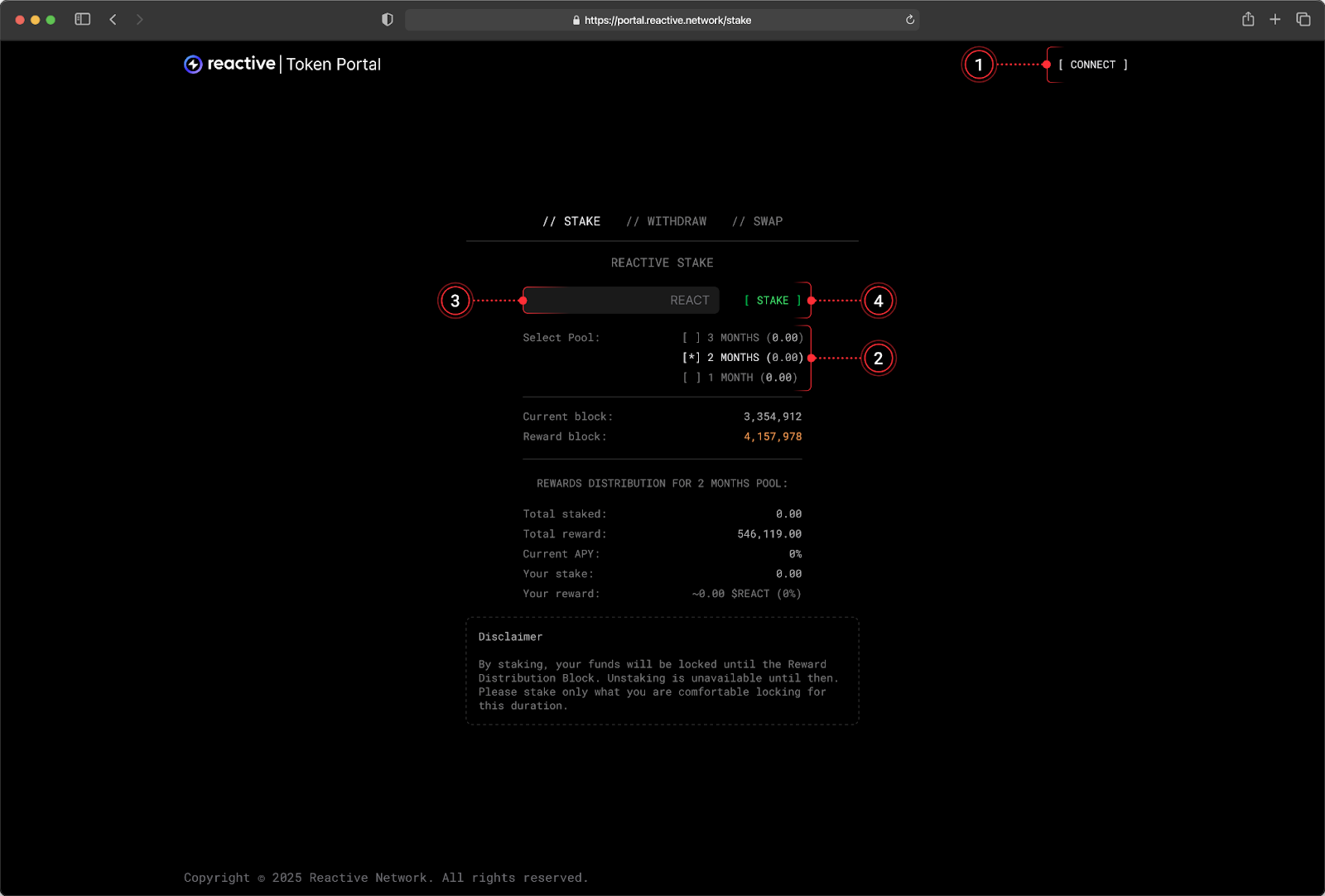

For new participants:

- Open the Reactive Token Portal and connect your REACT wallet.

- Pick your pool (1 month, 2 months, 3 months).

- Enter the amount of REACT you want to stake.

- Select Stake and confirm the transaction.

Once staked, your REACT remains locked for the full duration of the chosen pool. Principal + rewards unlock only when the pool concludes.

Recap

Season 3 wraps at block 3,384,799 on December 7th. A quick reminder: rewards do not distribute automatically — be sure to claim them through the Reactive Token Portal.

Then, without missing a beat, Season 4 launches at block 3,384,800, bringing a fresh reward pool of 2,268,494 REACT spread across three durations:

- 1-month pool — 147,032 REACT

- 2-month pool — 546,119 REACT

- 3-month pool — 1,575,343 REACT

For technical details on Reactive Network, visit Reactive Docs.

For more details on tokenomics, explore REACT Tokenomics & Staking.

About Reactive Network

Reactive is an EVM-compatible execution layer for dApps built with Reactive Contracts (RCs): a different beast from traditional smart contracts. Instead of waiting for user-triggered transactions, RCs use inversion of control, responding automatically to data flowing across EVM chains.

They listen for event logs on multiple chains, react with Solidity logic, and decide when to transmit updates to destination chains. This enables conditional cross-chain state changes without direct user prompts. Reactive runs on a parallelized EVM implementation for fast, low-cost execution.

Website | Blog | Twitter | Telegram | Discord | Reactive Docs

Build once — react everywhere!