Reactivity and Inversion of Control: Key Concepts of Reactive Smart Contracts

In this article, we discussed the basics of Reactive Smart Contracts (RSCs), what they are, and why we need them.

In the introduction article, we discussed the basics of Reactive Smart Contracts (RSCs), what they are, and why we need them. Let us dive a little deeper into the technical concepts of RSCs, as well as provide examples to illustrate those concepts.

How RSCs Differ from Traditional Smart Contracts

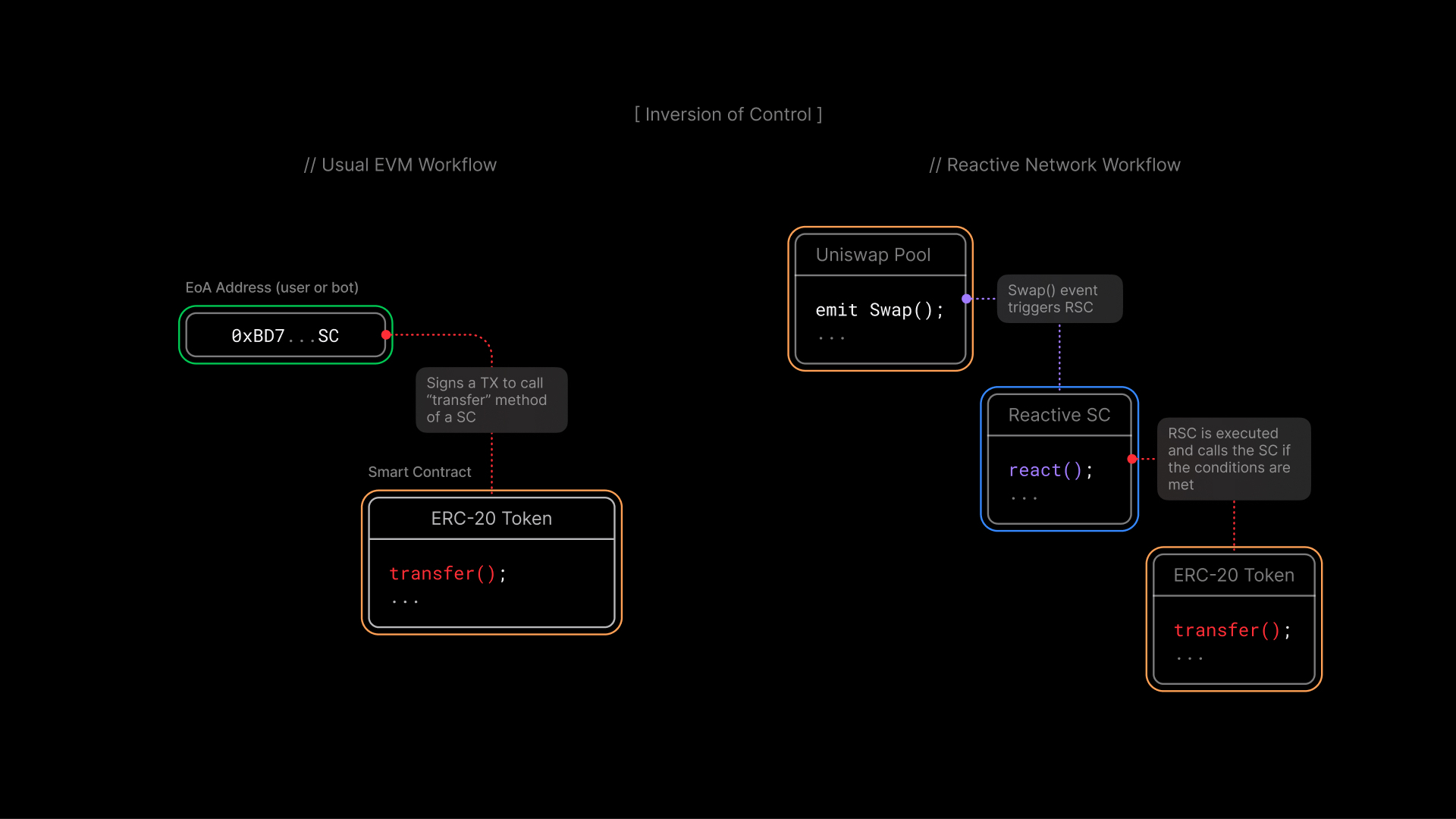

The main distinction between RSCs and traditional smart contracts lies in their reactivity. Traditional smart contracts are passive, only executing in response to direct EOA transactions. In contrast, RSCs are reactive, continuously monitoring the blockchains for events of interest and autonomously executing predefined blockchain actions in response.

Inversion of Control

A key concept in understanding RSCs is the Inversion of Control (IoC). Traditional smart contracts operate under a direct control model, where the execution of their functions is initiated by external actors (externally owned accounts, EOA, users, or bots). RSCs, however, invert this control by autonomously deciding when to execute based on the occurrence of predefined events. This IoC paradigm shifts how applications interact with the blockchain, enabling more dynamic and responsive systems.

Without RSC, you would need to set up a separate entity — a bot, let us say — to monitor the blockchains using existing (centralized, most probably) data solutions. This bot would hold the private keys (PKs) for the managed funds and initiate transactions on EVM chains from its EOA address. Though such systems prove to be useful, they might be suboptimal for some of the use cases and not suitable at all for others.

Inversion of Control allows us to avoid hosting additional entities that emulate humans signing transactions. If you have a predefined scenario outlining the sequence of transactions following on-chain events, you should be able to run this logic in a completely decentralized manner, as both your inputs and outputs remain on the blockchain. Reactive Network gives Smart Contracts the property they’ve been missing from the start — the ability to be executed automatically, without a person (or a bot) signing a transaction, just based on other on-chain events.

What Happens Inside a Reactive Smart Contract

When creating a Reactive Smart Contract, the first thing you need to specify is the blockchains, the contracts, and the events (Topic 0) of interest. The RSC will be monitoring these addresses for said events and will start the execution when it sees one. These events can be simple currency or token transfers, DEX swaps, loans, flash loans, votes, whale moves, or any other smart contract activity.

Once an event of interest is detected, the Reactive Network automatically executes the logic that you’ve implemented in your RSC. This could involve doing calculations based on the data from the events. RSCs are stateful, i.e., they have a state where values can be stored and updated. So, you can accumulate the data over history in the state and then act when the combination of the historical data plus the new blockchain event meet the described criteria.

As a result of the event, the RSC updates its state, thus always keeping it up to date, and can run transactions on the EVM blockchains. The whole process runs trustlessly within the Reactive Network, ensuring automatic, fast, and reliable execution.

Use Cases

Now, let us take a closer look at several use cases and use them to illustrate the concepts we’ve just discussed. This educational course will be structured around those use cases because we see practical application as the best way to learn the tech.

Collecting Data from Several Oracles

For RSCs to respond to a broader spectrum of events, including off-chain occurrences, they integrate with oracles. Oracles are third-party services that feed trusted external data into the blockchain. A simple example of such data would be exchange rates or sports event outcomes. RSCs can use this data to make informed decisions and execute actions based on real-world events, extending their applicability beyond the blockchain.

Moreover, since an RSC can monitor data from different smart contracts across different EVM-compatible blockchains, it can combine data from several oracles, making the resulting data more precise and decentralized. In that case, the events that RSCs will be monitoring are the updated events of the corresponding oracles. The calculation within the RSC will be combining the data from different oracles (for example, taking the average). The resulting action might be a trustless payout based on the outcome of the basketball game.

UniSwap Stop Order

Another example of a good data source on the blockchain would be a trading pool, such as a UniSwap pool. It would be even more reliable than the oracles since it’s pure on-chain data and we’re not relying on third parties.

In such a setup, an RSC would monitor the swaps on the specified UniSwap pool, calculating the liquidities and the exchange rate. When the exchange rate reaches a predetermined price, the RSC runs a swap transaction, thus implementing a trustless stop order on top of an existing DEX.

DEX Arbitrage

However, we can take the previous example even further by implementing an actual arbitrage using RSCs. Our Reactive Smart Contract will be monitoring several different pools for price discrepancies and capitalize on them. Both one-chain and cross-chain approaches are possible. In the first case, we can use flash loans. In the second case, we will need to have liquidities on several chains, but we will have access to more arbitraging opportunities.

The beauty of this solution is that it will be decentralized, unlike the traditional approach with bots. This allows for many improvements that we are yet to explore — hopefully, together with you, so please join our Telegram group.

Pools Rebalancing

While all the previous use cases imply building RSCs on top of the existing traditional Smart Contracts, the next one implies initially developing a DApp that relies on RSCs. If we design our system from the start, knowing that we’ll be able to use the Reactive Network technology, we can build our Ethereum Smart Contracts utilizing the functionality of RSCs.

That way, we can potentially build liquidity pools that would automatically rebalance across several exchanges. The RSC will monitor the liquidities on all chains of interest and rebalance them by adding or draining funds when needed.

Conclusion

These are just a few possible use cases of Reactive Smart Contracts. We’ll be covering them, and many more, in this Reactive Course. This way we will be able to fully explore the RSC tech together. More than that, we will be in close touch with you, the developers, to come up with more use cases and techniques together. So stay tuned and join our Telegram/ Discord group.

Join our Hackathon and bounty program today to start building with Reactive Smart Contracts and bring your innovative ideas to life on the Reactive Network!

About Reactive Network

The Reactive Network, pioneered by PARSIQ, ushers in a new wave of blockchain innovation through its Reactive Smart Contracts (RSCs). These advanced contracts can autonomously execute based on specific on-chain events, eliminating the need for off-chain computation and heralding a seamless cross-chain ecosystem vital for Web3’s growth.

Central to this breakthrough is the Inversion of Control (IoC) framework, which redefines smart contracts and decentralized applications (DApps) by imbuing them with unparalleled autonomy, efficiency, and interactivity. By marrying RSCs with IoC, Reactive Network is setting the stage for a transformative blockchain era, characterized by enhanced interoperability and the robust, user-friendly foundation Web3 demands.